Volatile times: Storm & calm & storm

In less than a month, most equity markets plunged around 10 per cent to multi-month lows

Samie Modak Most global markets, including India, have tumbled on China's decision to lower the value of its currency. The latest decline in major markets has been an average five per cent, after China's central bank move to peg the reference rate lower by 0.5 per cent.

A bigger crash was witnessed across markets when China shocked everyone by devaluing its currency by two per cent on August 11, 2015. In less than a month, most equity markets plunged around 10 per cent to multi-month lows.

The markets, however, saw an equally sharp rebound after September, amid steps taken by China to restore calm in its market and economy. Experts expect the sharp bouts of sell-off and buying to continue, due to uncertainty on many fronts.

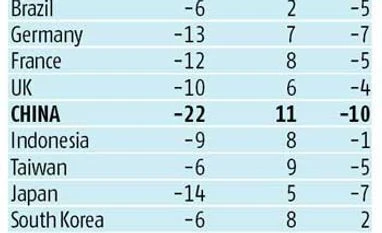

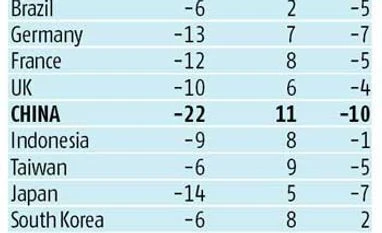

Possibility of a currency war will continue to be one of the biggest risks for the market in 2016, they say. Another round of devaluation by China might send shockwaves across the financial markets and prompt other countries to also peg their currencies lower to maintain competitive advantage. This could lead to fund outflows from emerging markets.

)

)