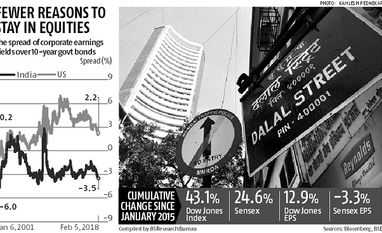

The benchmark Dow Jones is currently valued at 20.5 times its trailing 12-months earnings, up from 16x at the beginning of 2015.

Analysts say poor earnings growth is not a concern as long as interest rates (or bond yields) are low, justifying continued investment in equities.

“The sudden weakness in equity markets can be traced to the unexpectedly strong labour markets in the US with higher than estimated hiring by the private sector and a steady rise in salaries and wages. For example, at 2.8 per cent year-on-year rise, wage growth in the US during 2017 was the highest in nearly a decade. A tight labour market could translate into higher retail inflation and faster than anticipated rate hikes by the Federal Reserve. This spooked investors, leading to a sell-off,” said Dhananjay Sinha, head, research, Emkay Global Financial Services.

)