Will FII inflows start slowing?

They have put in $14 billion so far in 2014 but this could get slower if the US Fed raises rates; however, there are expectations on compensatory flows

Sneha PadiyathSamie Modak Mumbai Talks of an imminent interest rate increase by the US Federal Reserve have raised concern that foreign investor flows into the Indian market might get slower.

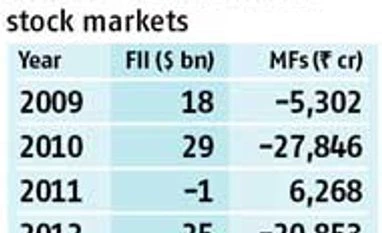

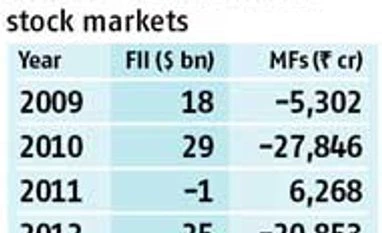

So far this year, investment by foreign institutional investors (FIIs), a key driver for the stock market rally, has crossed $14 billion, one of the highest among major emerging markets (EMs). The benchmark indices have rallied nearly 30 per cent in 2014.

Experts say foreign investor flows will have to remain strong for the market rally to sustain. Investors from abroad will have to put another $5 bn to surpass their last year’s tally of $19 bn. The Street is concerned that FII flows into India could also be impacted by the tapering in the US Federal Reserve’s stimulus package — termed quantitative easing-3 (QE3). The Fed would meet next week to announce a further tapering in QE3 by $10 billion a month, which would lead to its closure in October. However, the real concern is on an interest rate increase by the Fed, which could see a reversal of flows to the EMs. Shane Oliver, head strategist of Australia-based AMP Capital, says a greater focus on economic data is unlikely to change the timing of the first rate rise in the June quarter of 2015, which might cause a bit of market volatility.

“Currently, the Fed states that it anticipates a ‘considerable time’ between the ending of QE and the first rate hike, with this taken to mean six months or more,” he states.

FIIs had pumped in about $12 billion till August last calendar year. The pace of FII buying had picked up after August, when the Sensex was around 18,000. Since then, the market has rallied about 50 per cent and the Sensex trades above 27,000.

FII flows into the Indian market this year, like the previous year, have been more than most EM peers, such as South Korea, Taiwan or Indonesia. This could continue in case there is a rollback in US monetary policy, believe analysts.

“As we move towards expectations of a faster than anticipated normalisation of US monetary policy, we will see an increasing degree of investor discrimination within EMs. A sharp improvement in India’s external vulnerability indicators, a highly credible Reserve Bank of India, a government focused on economic growth and, importantly, an environment of softer global commodity prices should help India differentiate itself from many of its EM peers,” states Abhay Laijawala, managing director and head of research, Deutsche Equities India.

Even if the flows from the US market get slower, market players are betting investments will come from other regions such as Europe and Japan, where monetary policy continues to remain loose. “Investors from Europe, Japan and now China have expressed interest in investing in India. So, a large amount of money will come into the Indian markets,” said Deven Choksey, managing director, Choksey Securities.

Also, experts believe domestic institutions, such as mutual funds (MFs) and insurers, will provide support to the market if there is a slowing in foreign flows.

MFs, flush with investor flows, have pumped Rs 15,000 crore into the Indian market since the new government came to power in May. This is in contrast to last year, when MFs had sold shares worth Rs 20,000 crore; they have been net investors so far in 2014, to the tune of Rs 4,500 crore.

)

)