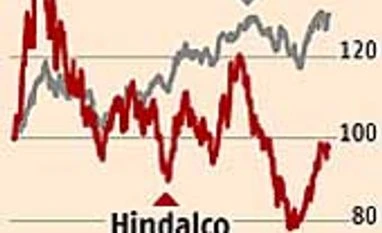

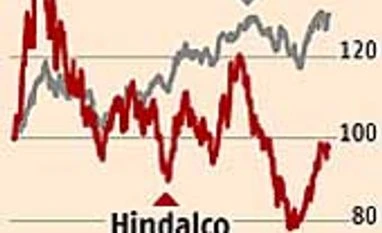

Hindalco's Q4 numbers show sequential improvement

Analysts worried over sharp increase in gross debt and 96% increase in interest expenses

Malini Bhupta Mumbai Hindalco's fourth quarter numbers are a mixed bag. If one compares Hindalco's fourth quarter numbers with its last year's performance, it will continue to indicate the stress the metals and mining sector is under. However, if one compares the performance sequentially, it shows things are improving. While the sequential improvement is positive, the sharp uptick in debt has come as a negative surprise.

Compared to last year, Hindalco's net sales fell nine per cent during the fourth quarter but rose two per cent to Rs 7,000 crore sequentially. Volumes are down compared to last year but sequentially these have picked up. Copper cathode and alumina volumes have remained flat sequentially, though these are substantially down year-on-year (y-o-y). Operating profit rose 11 per cent sequentially to Rs 640 crore, but was down 26 per cent y-o-y. What remains unchanged is the pressure on costs. High input costs (especially higher fuel and power) have kept operating margins under stress, which declined 211 basis points y-o-y to 9.2 per cent in Q4 but expanded 73 basis points sequentially. The sequential improvement suggests things are not worsening.

Other than a sequential uptick, there are two key positives. First, the company has announced "first tapping of the metal" has commenced at the Mahan plant. After much delay, the plant has finally commenced production, which has a capacity of 359 kt. The other positive is the higher-than-expected net profit, at Rs 482 crore (up 11 per cent sequentially). This spike in net profit is largely driven by a lower effective tax rate of 11 per cent during the quarter, compared to 20 per cent in the third quarter. Also, other income at Rs 230 crore has come in much higher than the quarterly run-rate of Rs 140 crore. However, compared to last year, net profit is down 25 per cent, below the estimates of some analysts.

The bad news is that gross debt has shot up sharply. Thanks to the commissioning of several new projects, and a consequent drawdown of debt, the gross debt has risen to Rs 55,000 crore from Rs 40,000 crore last year. According to Goutam Chakraborty of Emkay Global, this is a clear negative in the short term. Interest expenses, have risen substantially by 96.9 per cent y-o-y to Rs 158 crore on the back of new bonds raised during the first half of FY13, says Bhavesh Chauhan of Angel Broking. Analysts are more concerned as the company has not indicated any timeline by which the Mahan smelter will commence production. Till there is clarity on how the company intends to address the rising debt burden and costs associated with it, investors will remain cautious.

)

)