Infosys Technologies: FY13 a year of readjustment

Cedes margin leadership as it focuses on growth, might guide for 10-13% revenue growth in FY14

Malini Bhupta Mumbai Infosys Technologies might not have started FY13 on a good note but it's expected to exit the year on a much happier one. In Q1, the company's dollar revenues contracted 1.1 per cent to $1.75 billion, while rivals grew at a steady clip. The company surprised the market during Q3 by growing organically, too. While the acquisition of Lodestone was expected to shore up the company's revenues, the revival in organic growth took the market by surprise. Infosys is now expected to exit the year with a sequential growth of 2.8 per cent in dollar revenues (organic). Including Lodestone revenues, Infosys is likely to post a sequential revenue growth of four per cent.

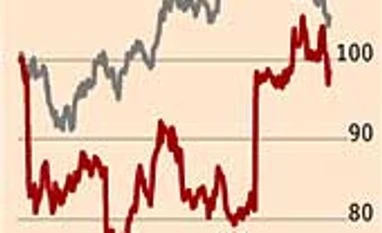

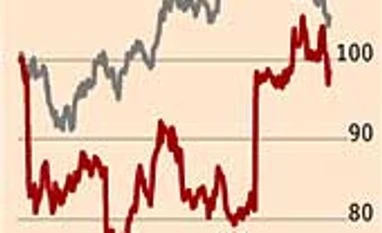

This revival has come at a price. Infosys, which till recently refused to compromise on margins, has come to terms with a much lower trajectory. It had led the sector on this front but has learnt to compromise as the trade-off between growth and margin had turned unfavourable. Analysts expect operating margins of 28 per cent in Q4, a 490-basis point decline on a year-on-year basis and 80 basis points (bps) sequentially. Not just Infosys; the software services sector, too, has been realigning itself to a lower margin trajectory. Q4 is expected to see margins decline on a rise in onsite hiring, cross currency movements, hiring in the local market and weak volumes. JP Morgan says: "By stating a mid-20 per cent margin aspiration, Infosys has reconciled itself to ceding margin leadership to TCS - a thought unimaginable six months back. This is an important sychological barrier to cross for the company which prided itself on margin leadership, allowing it to more finely walk the growth versus margin trade-off."

The market will watch for Infosys's FY14 guidance. The company has been giving revenue and earnings forecast to prevent volatility in the stock, but as it has missed its own guidance several times, analysts have been in favour of Infosys not giving any forecast. But any guidance will be critical, as it will indicate how confident it is of achieving the target. Analysts broadly expect Infosys to give a dollar revenue growth guidance for FY14 of 10-13 per cent. Kotak Institutional Equities is expecting Infosys "to guide for at least 13 per cent dollar revenue growth in FY14 and earnings per share (EPS) of Rs 174.2, a 6.9 per cent growth. EPS guidance may assume 110 bps of margin decline."

)

)