Markets factoring in 10% rise if stable coalition forms govt

Implementation key to reviving growth, rather than radical economic policies

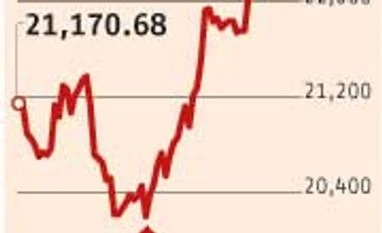

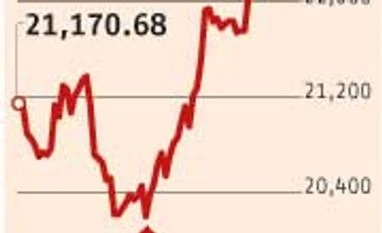

Malini Bhupta Mumbai The pre-election rally has played out along expected lines, with the benchmark index rising 11 per cent since February. With elections kicking off on Monday, Dalal Street is already trying to assess the possible scenarios that will emerge after May 16. The market is factoring in a 'stable government', which will manage to cobble the required numbers, though the possibility of a third front is not ruled out. Therein lies the risk of markets running ahead of themselves and becoming a victim of their own ever-growing expectations, says JPMorgan. While the election day is most likely to see a double-digit swing in the benchmark indices, what will matter more to the Street in the medium term will be the stability of the government.

Given that the manifestos of the two national parties read alike, Dalal Street is interested in the ability to implement. Consequently, the markets are only factoring in two kinds of scenarios - a stable coalition and a fragmented one. A stable coalition (read Bharatiya Janata Party-led National Democratic Alliance) would be one where the leading party has over 180-200 seats and have support from three to five regional parties. This would be the best case scenario as economic growth would eventually revive in such an event and rupee would stabilise after appreciating initially.

According to Bank of America-Merrill Lynch, a stable coalition and expectations of appreciating rupee would lead to a shift to domestic plays which are under-owned and have underperformed. In such a case, high quality cyclicals like Maruti and ICICI Bank would do well along with reform plays like ONGC. However, the markets might drop 15-20 per cent in case a fragmented coalition, comprising more than five regional parties, comes to power. In such a scenario, strategists recommend stocking on exporters and defensives like Tech Mahindra, TCS, Lupin, HDFC and ITC.

Historically, markets have risen after elections and it may move up by another 10 per cent if a stable government comes to power. However, such an event might not guarantee revival of growth and lower interest rates. The next government will be faced with the mammoth task of maintaining macroeconomic stability while reviving growth. None of this is going to be easy, as a vast majority of the projects cleared by the UPA government in the run up to elections now depend on clearances from state governments.

A BJP government will not be able to kick-start these projects if state governments do not play ball. The markets are lulled into a sense of belief that the capex cycle will revive in FY15, once the bottlenecks are removed. JPMorgan's Sajid Chinoy says it best: "Growth next year will have to contend with potentially both tighter monetary and fiscal policy. For now, however, equity markets will have none of this."

)

)