Maruti: Moving away from core competence a concern

Peaking valuation, unconventional deal with parent, concerns over premiumisation drive downgrades

Malini Bhupta Mumbai Displeased with Maruti Suzuki’s decision to enter a contract manufacturing agreement with its parent Suzuki Motor Corp, investors have started hitting the sell button. Maruti's shares fell 3.6 per cent on Monday, after Jefferies, a foreign brokerage firm, downgraded the stock. While the board's decision was expected, several other concerns have surfaced of late, which hit the stock. The immediate one is the rather unusual agreement that Maruti intends to sign with Suzuki, once minority shareholders approve of it. Under the agreement, Suzuki will manufacture cars for Maruti on a 'no-profit-no-loss' basis. Analysts claim the unusual nature of the agreement will continue to be an overhang for the stock in the near term. Jefferies says Maruti is stepping out of areas of core competence, but investors are focused only on its bright near-term prospects.

The car maker is also doing other things it has never done before, like increasing its focus on larger cars and acquiring land to build warehouses to improve distribution.

According to some analysts, S-Cross volumes have not been very encouraging in September. Nitesh Sharma of Phillip Capital believes that entering the premium segment is a step in the right direction from the point of view of customers and investors.

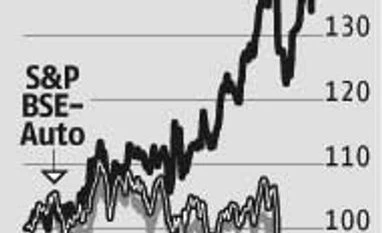

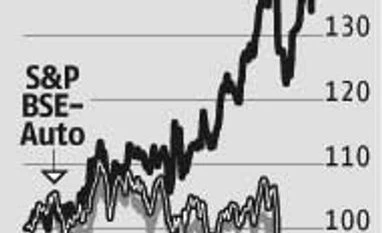

The stock was trading at 22 times its FY17 earnings (before the downgrade) and analysts believe it prices in all the positives. Jefferies says, "The near-term outlook is very strong. The stock trades at all-time high multiples on peak profitability." Maruti's shares have risen 33 per cent since January this year, while the Sensex has declined three per cent in the same period. Despite the re-rating, there's little room for upside.

Domestic sales and exports have disappointed in September. While many blame this on the change in the festive period compared to a year ago, others believe automobile sales are not expected to grow at the pace anticipated at the start of the year.

Maruti's volumes grew 3.7 per cent year-on-year (y-o-y) in September and declined 3.5 per cent month-on-month. Exports declined by 27 per cent (y-o-y) due to shipment delays. JMFinancial says the September sales trend is not an encouraging build-up to the festive season, and the month has turned out to be a largely weak one for passenger segments.

)

)