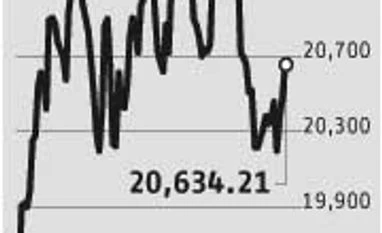

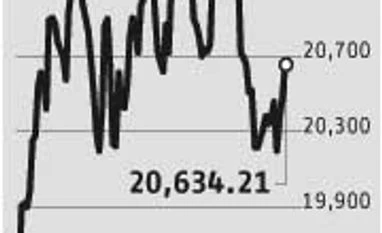

Net profit of Sensex companies rises 24% in third quarter

A large part of this growth is driven by weak rupee and other income; quality of earnings remains weak

Malini Bhupta Mumbai The third-quarter earnings season has ended on a positive note and no downgrades are imminent. The net profit of 30 Sensex companies has increased 24 per cent compared to last year. Sequentially, too, these companies have grown their earnings by 14 per cent. Even if one takes adjusted profits of the 30 Sensex companies (adjusted for one-time gains), their net profit has risen 23 per cent year-on-year. A large part of the good earnings cheer has been driven by export sectors such as pharmaceuticals and information technology (IT). This pattern is similar to the second quarter, during which earnings had gotten a boost from the rupee’s fall. So, does this mean the quality of earnings is actually improving? Clearly not, even though margins have expanded during the quarter.

There is no doubt that exporters have benefited from the rupee’s fall but with the currency stabilising at current levels, the future upside is limited. There is more to the third-quarter earnings than the 'positive surprise'. Analysts say that while the third-quarter earnings have surprised positively, the quality of earnings is still not something to write home about. Over the past several quarters, the profit before taxes of Nifty 50 companies has been boosted by other income. Higher other income has come to the rescue of several large companies over the last several quarters.

With the rupee remaining stable, the sustainability of earnings growth is not a given. The second big trend this quarter has shown is the weakness in volume growth. Most consumer companies — with the exception of some — have shown a collapse in volumes. This is not yet reflected in the valuations of consumer companies. Even though operating profit of Sensex companies has improved sequentially and annually, there are different factors that have led to this improvement. The improvement is not due to a secular pick-up in growth. Kotak Institutional Equities believes the sequential improvement in operating margins of auto companies is due to decrease in raw material costs and or lower operating costs. On the other hand, year-on-year decline in margins of cement companies is because of lower prices and weak volumes. The earnings season may have ended on a good note, but the macro-economic signs are still ominous as bank credit has slowed sharply, demand is steadily declining, and volumes are falling across sectors. The sustainability of earnings growth depends on economic growth.

)

)