New measures positive for PSU bank stocks

Incremental newsflow around NPA resolution will drive performance of PSU banks

)

Explore Business Standard

Incremental newsflow around NPA resolution will drive performance of PSU banks

)

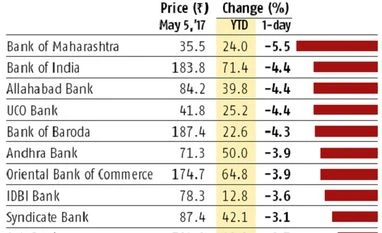

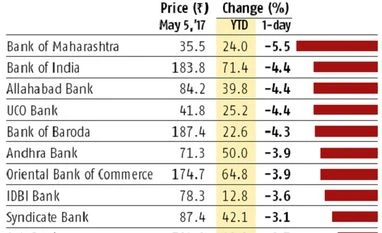

Part of this weakness can be attributed to the strong surge witnessed by these stocks in recent times in anticipation of concrete measures to solve the bad loans issue. Lack of clarity around further action by the Reserve Bank of India (RBI) as well as quantum of hair cuts required to be taken by the banks while selling or liquidating the bad loans were other factors that pulled down the banking stocks in Friday's session.

Nevertheless, it is a step in the right direction. As bankers were sceptical to take any decisions, the new measures pass the baton to RBI, which will now have more powers and is expected to deal with the bad loans issues firmly.

Mahesh Patil, co chief investment officer (equities), Birla Sunlife Asset Management, says, "Banks will have to take haircuts and weaker PSU banks will see a hit on their balance sheets. But, if resolutions happen, then at least after taking the haircut, banks won't have to make further provisions. That is a positive, if it is implemented."

There are, however, questions, too, which pertain to the pace of bad loan resolution among others.

Siddharth Purohit, Banking analyst at Angel Broking, says, "Albeit the overhang on the banking stocks shall be the excess provisioning required to be undertaken if deep hair cuts are taken on the stressed assets, there are advantages as well. Certain grey areas need to be addressed such as whether RBI will be part of the commercial making decision and are banks in state of health to take deep hair cut?" If they are not, will the onus of recognising the hair cut taken be reflected on the bank's balance sheet or will the RBI provide some cushion in absorbing the excess stress, he adds.

The measures, however, indicate the strong intention of the government and RBI to solve the bad loans mess. From here on, incremental newsflow around resolution will drive performance of PSU banks and should restrict significant downside for the stocks.

Meanwhile, experts have started considering select quality names in the PSU banks space. Patil says, "We were very averse to PSU banks a year-ago; now we are selective. We like banks which are well capitalised, we are comfortable with the top management and where they have cleaned their books pretty well."

Already subscribed? Log in

Subscribe to read the full story →

3 Months

₹300/Month

1 Year

₹225/Month

2 Years

₹162/Month

Renews automatically, cancel anytime

Over 30 premium stories daily, handpicked by our editors

News, Games, Cooking, Audio, Wirecutter & The Athletic

Digital replica of our daily newspaper — with options to read, save, and share

Insights on markets, finance, politics, tech, and more delivered to your inbox

In-depth market analysis & insights with access to The Smart Investor

Repository of articles and publications dating back to 1997

Uninterrupted reading experience with no advertisements

Access Business Standard across devices — mobile, tablet, or PC, via web or app

First Published: May 05 2017 | 11:59 PM IST