NMDC: Q3 beats estimates on better product mix

Despite price cuts, better product mix boosted realisations; positive prospects ahead

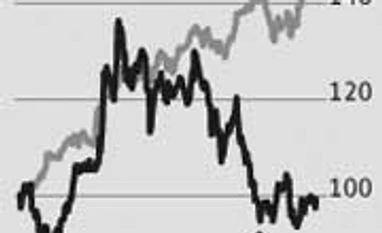

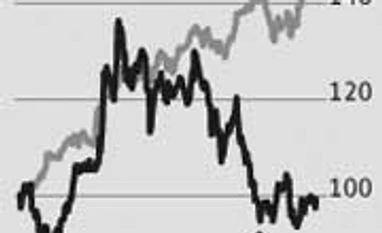

Ujjval Jauhari The NMDC stock gained 1.7 per cent on Friday after the company's December quarter results comprehensively beat the Street estimates. Falling international iron ore prices in the past four to five months have put pressure and the stock stumbled from Rs 196-184 in June-September to Rs 140.75. Though NMDC had maintained ore prices till the September quarter, on the back of firm domestic demand, it had to cut thereafter. Despite this, realisation in the December quarter was better than expected. Analysts attribute it to a better product mix, namely, a higher proportion of lump sales.

The Bloomberg consensus estimate for sales was Rs 2,870 crore but actual net sales were Rs 2,944 crore. Ebitda (earnings before interest, taxes, depreciation and amortisation) at Rs 1,948 crore was ahead of the Street estimate (Rs 1,776 crore). Though tax expenses increased Rs 27 crore (the tax rate was up a tad), net profit at Rs 1,593 crore was higher than the estimate of Rs 1,517 crore.

In the December quarter, ore production grew 19 per cent over a year to 8.36 million tonnes (mt). For the first nine months of the financial year, consolidated production increased 11.5 per cent to 22.5 mt and sales grew 8.2 per cent to 22.83 mt over the year-ago period. NMDC continues to see regular traction in production and sales from its mines in Chhattisgarh and Karnataka, as demand remains strong due to supply bottlenecks.

The company, able to roll-over its December prices for lump-ore (Rs 4,200/wet tonne) and fines (Rs 3,060/wet tonne) to January, has cut prices in February to Rs 3,750/wet tonne and Rs 2,760/wet tonne, respectively. Analysts at Motilal Oswal Securities say a cut in prices by Rs 300/200 for lumps/fines for February, however, are much less than the Rs 600-650/tonne cuts taken by Odisha-based miners.

This is because domestic iron ore supply is likely to improve, with Supreme Court directing re-start of some captive mines and increase in mining limits of a few Odisha mines. Also, lower international prices would increase imports, while lobbying for a lower import duty on iron ore could put further pressure on prices. Analysts, however, believe this is more than factored in the current stock valuation. Positively, the easing of mining regulations will enhance NMDC’s volumes, partly offsetting the pricing pressure.

The company is also well-placed to benefit from forward integration. It is setting up a three mt per annum steel plant in Chhattisgarh, expected by FY17. Notably, the cash-rich company (cash & bank balance of Rs 48 per share) is not likely to take any leverage on its books. In addition, it has an excellent dividend history. Though the business environment remains weak, 60 per cent of the 38 analysts polled by Bloomberg have a 'buy' on the stock, with a consensus price of Rs 168.

)

)