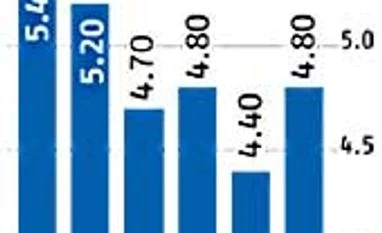

Q2 GDP growth at 4.8% points to economy bottoming out

Recovery not in sight yet as services growth falls below 6%, levels last seen in 2001

Malini Bhupta Mumbai The Indian economy may have bottomed out, if the 4.8 per cent GDP growth in the July to September quarter is an indication. While this is marginally ahead of consensus estimates (4.6 per cent), it needn't be interpreted as a recovery yet because services and industry are still struggling. This quarter's growth has largely been driven largely by a pick-up in agriculture (4.6 per cent), financial services (10 per cent) and industry (2.4 per cent). Government spending has declined by one per cent during the quarter and going forward, this will continue to decline as fiscal prudence will drive spending cuts.

Compared to the 4.4 per cent seen in the April to June quarter, the second quarter numbers may be better, but this recovery is not broad-based. Nomura's India economist Sonal Varma says GDP growth is still bottoming out in the 4.5-5.0 per cent range. However, a more sustained growth uptick is only likely in the July-September 2014 quarter, once political stability has been established and export growth stabilises at higher levels. The Q2 GDP growth may have come in higher than Q1's 4.4 per cent due to a pick-up in the primary sector, but this cannot be viewed as a recovery. While a spike in agriculture was largely expected, the growth in finance was a surprise, which grew at 10 per cent. Finance and insurance growth is a positive sign as the segment has an 18 per cent share in overall GDP. Credit growth improved in the second quarter, and economists expect it to sustain in the coming quarters.

A good monsoon and a marginal pick-up in mining and construction helped improve the overall headline figure, but two of the biggest components of GDP continue to struggle. Economic growth is expected to continue to languish between 4.5-5 per cent for the next few quarters.

The biggest shock has come from the services segment. Growth in the service sector, which accounts for 60 per cent of GDP, fell 170 basis to 5.9 per cent. The service sector growth fell to below six per cent levels last in 2001. In the new series (2004-05), services growth has never fallen below six per cent, say Tirthankar Patnaik and Prerna Singhvi of Religare Capital Markets. This is a worrying sign. Industry growth too remained well below the potential at 2.4 per cent. Going by the current trend, economists expect the primary sector to continue to report recovery but it would not drive overall growth. Going by this, economists do not expect a sustainable recovery till the third quarter of calendar 2014. Bhupali Gursale of Angel Broking expects real GDP growth during FY2014 as a whole to range between 4.5-5 per cent, owing to near-term challenges in the macro environment mainly from subdued domestic demand, fiscal constraints and the muted investment outlook.

)

)