Rohit Kapur, Vivek Pandit & Toshan Tamhane: PE in India - Setting new benchmarks

Private equity as an asset class has had a significant impact on investee companies as well as the economy. Yet there is room to improve in terms of eventual returns

Rohit KapurVivek PanditToshan TamhanePrivate equity (PE) has provided over $100 billion of capital to India Inc in the last 13 years, an impressive figure by any reckoning. It has helped scores of companies tap a new funding source and yet is considered to have had mixed success. This is perhaps a good time to assess the nature of this very high-profile source of capital and also to consider the impact it has had on the various participants.

Has PE capital really helped bring in new skills and capabilities to investee companies? One view is that the capital has simply pushed companies to sweat assets, take on excessive leverage and strip non-essential components to benefit a few. Probably the much bigger, and more useful question to ask is whether the investments have really benefited the country. McKinsey & Company's new report on the 'Indian Private Equity: Route to Resurgence' analyses the impact of PE investments. At multiple levels we used advanced data analytics and surveyed dozens of stakeholders including the key regulators. Here is what we found.

Private equity contribution to equity fund-raising has increased over the past fifteen years. It grew from being 20 per cent of total capital raised in 2001-05 to 31 per cent in 2006-10, moving further up to constitute 47 per cent of total capital raised in 2011-14. It has, over time proved to be a more stable source of equity funding when compared to the other sources including foreign institutional investment, IPOs and equity issuances like secondary offers and convertible instruments. The standard deviation of PE capital over the last 13 years is lower (76 per cent) as compared to other major sources like FII (100 per cent), IPOs (103 per cent) and convertible bonds (122 per cent).

Now during this timeframe, approximately 3,100 companies received private equity infusion, of which roughly half are companies with revenues less than $2 million and another 30 per cent are companies with revenues less than $125 million. This highlights the pivotal role of this kind of capital has played in the development of early-stage ventures and small and medium enterprises. The risk appetite of private equity investors has undoubtedly helped shape the development of some critical industries in their formative years. The most well-known and oft-cited example is mobile telecommunications. Four of the top ten Indian telecom companies and seven of the top nine tower operators were funded by private equity capital. Numbers are similar for information technology services, where six of the top fifteen companies were funded by private equity.

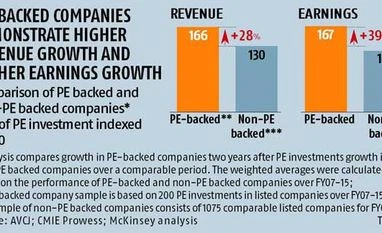

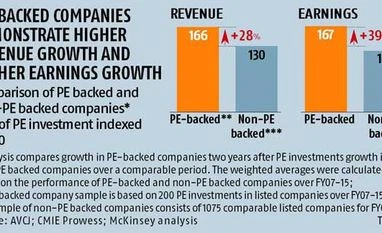

One clear impact visible in portfolio companies is accelerated job growth. In the five years following initial investment, companies backed by private equity grew direct employment six per cent faster than companies not backed by private equity. From the point of the underlying investee companies, as Table 1 shows, private equity-backed companies grew faster than the non-private equity backed ones, both in terms of revenues as well as profits.

Our study also found the impact to be much deeper and structural. Private equity has often facilitated and encouraged investee companies to build strategic capabilities. Here's the evidence: exports at PE-backed companies grew 60 per cent faster than those at non-PE backed companies; moreover, over 80 per cent of private equity backed companies made their first cross-border merger and acquisition, after they had received private equity funding. The correlation holds at an overall level as well as by and by industry, suggesting that the investors brought to bear their global experience, foreign market access, deal-making expertise and network. This has supported investee companies.

A big advantage of private equity investment, which is not highlighted often enough, is the governance dividend. Private equity investors have been able to influence investee companies to enhance their corporate governance standards through measures like appointment of independent directors, better functioning of the Audit and Compensation Committees as well as increased oversight from the board. When we asked portfolio companies to name the most significant contribution by private equity board members within six months of investment, 65 per cent of the executives surveyed pointed to material changes in compliance and governance measures, including appointment of new auditors.

However, this is not entirely a rosy story. The impact record also has a few shortcomings. In the years prior to 2008-09, private equity investors often took minority positions - in more than 62 per cent of the transactions, private equity took less than 25 per cent stake, often without major governance rights. This made it difficult to influence the company in any meaningful manner. Not surprisingly, there were more than a few disputes with the promoters over strategy, operational value-creation and timings of capital events.

When viewed from the point of view of the providers of capital to the private equity firms, the record has been checkered. Of the $51 billion invested till 2008, only $16 billion has been able to exit till 2014, that too at a multiple of 1.7X, yielding returns that were far below expectations. One might argue that this was because of a host of underlying causes that range from the global downturn post-2009 and the devaluation of Indian rupee. But the impact on investors is undeniable. What pinched them even more was the high entry price while making the investment and restrictive exit routes.

Overall, the conclusions of our study are optimistic. It is clear that private equity as an asset class has had a significant impact on investee companies as well as the underlying economy. Yet there is room to improve in terms of eventual returns. A more collaborative, operating model will be needed as we move forward. The Indian economy is getting back into gear and private equity could play a big role in powering it, albeit with a few alterations.

Rohit Kapur is a client director, Vivek Pandit is a senior partner and Toshan Tamhane is a partner at McKinsey & Company in India

These are personal views of the writer. They do not necessarily reflect the opinion of

)

)