40 Years Ago...And now: From outcry to just a click

Brokers trade over the terminal and with just a click of a mouse, buy or sell shares

Joydeep Ghosh Most old hands in the stock market remember the BSE's ornate trading floor. Between 12 noon and 2 pm, brokers used to gather there and shout their buy/sell orders.

Those days of shouting bids (known as the outcry system) are over. Even the trading corners, according to a company's geographical location, no longer exist. For example, Madras Patiya (Patiya means location) or Calcutta Patiya was reserved for people selling shares belonging to Chennai (then Madras) and Kolkata (then Calcutta)-based companies.

Everything is now just a click away. Brokers trade over the terminal and with just a click of a mouse, buy or sell shares.

Arun Kejriwal, director, Kris Securities, was just 15 when he started trading in odd-lot physical shares in the late sixties. Why odd-lot? These lots weren't so liquid and were sold at an 8 to 10 per cent discount to the lowest price. Usually, shares traded in lots of 50s. Odd-lot shares would be in numbers of 12, 18 or 35.

Individuals can now trade through mobile phones and buy just one share of a company due to dematerialisation.

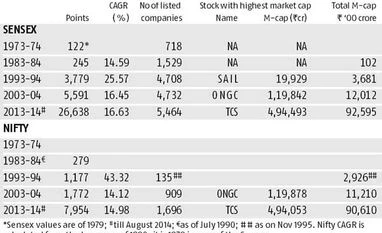

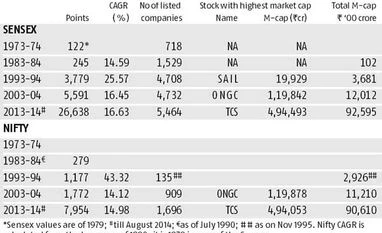

The number of stocks listed on the BSE in 1973-74 was 718; that has increased to 5,453 now, compared to 1,950 on the National Stock Exchange (set up in 1993) and 1,100 on MCX-SX, set up four years ago.

Only six stocks have retained their place in the Sensex since its launch in 1986. These include Reliance, Hindalco, Hindustan Lever (now Hindustan Unilever), ITC, Tata Motor, Tata Steel.

The first list of companies on the Sensex were mostly brick-and-mortar models or multi-national companies. Companies like Infosys didn't exist then and TCS wasn't listed. Though the official launch was in 1986, the BSE has back computed Sensex (base year 1978/79 = 100) to April 1, 1979.

Over the years, simply investing in the Sensex would have yielded substantial returns. Despite the ups and downs and multiple scams, the Sensex, has risen from 122 to 26,000 in 35 years - a compounded annual growth rate of 16.6 per cent. Many stocks have outperformed the index. For instance, 100 shares of Wipro bought in 1980 would have multiplied to 9.6 million shares due to splits and bonuses. Its current value: Rs 542.78 crore (Rs 565.40 per share).

One thing that hasn't changed over the years - though it has become more organised - is the habit of giving free stock tips. As Kejriwal says: "The dhotiwala kaka (brokers, mostly Gujaratis, used to wear dhotis on the trading floor) would just say 'aaj sharu lage che' (this stock looks good today)."

Even today, there are brokers who send SMSes with stock tips daily.

)

)