When health insurance was developed initially, it was meant only to cover a person’s hospitalisation and surgical expenses. It has since then evolved steadily in its effort to take care of all the health problems that customers may face. Surgical treatments of haemorrhoids, tonsil removal, cystoscopic removal of stones, and so on were not covered by traditional health insurance plans until a few years earlier, but are taken care of under day care benefit by most plans today. In some areas, such as OPD (out-patient department) cover, however, limitations remain.

Owing to growing risks from environmental hazards and lifestyle diseases, people are visiting hospitals frequently nowadays for smaller medical interventions, such as consultations for minor health issues, diagnostic tests, pre-emptive check-ups, etc. At least the one-fifth of Indians who have chosen to buy health insurance don’t like to take a chance with their health, according to reports. However, these visits burn a hole in the pocket, especially of those who live in the big metros.

While day care treatments have now been integrated into most new health insurance offerings, OPD cover continues to be omitted by most flagship products. This is seen as a major irritant by the population that buys health insurance. Buyers believe that a health insurance policy should take care of every small cost they might incur on health. If they still have to pay for health issues, they become disgruntled.

The rising burden of OPD spending is making such a cover even more critical. In India, a whopping 60 per cent of health care spend is on OPD treatment. The lack of an efficient mechanism and absence of a closed network structure are the chief obstacles preventing insurers from introducing worthwhile and sustainable OPD products.

A few insurers have now developed an in-built OPD feature in their health insurance policies. These include Star Comprehensive Health Insurance plan, Cigna TTK Prohealth, Royal Sundaram Lifeline Elite, Universal Sompo’s Individual Privilege Health Insurance Plan and Apollo Munich’s Health Plan for PolicyBazaar.

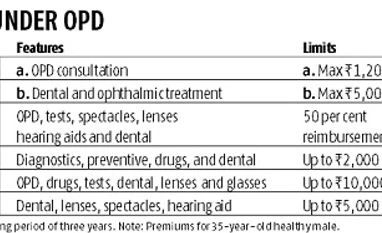

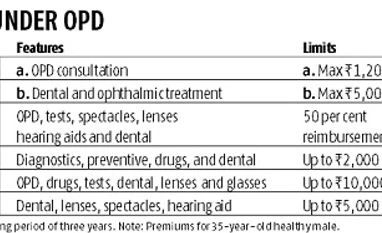

Do OPD plans offer good value? This is a difficult question to answer because OPD features are not priced separately but are bundled with plain-vanilla health insurance plans. This is primarily because a separately priced OPD feature doesn’t follow the principle of insurance and spread of risk, resulting in an almost 100 per cent pricing for the benefits provided. For the benefit of customers here’s a snapshot of the health insurance plans that carry OPD as an in-built feature

(See table: What is covered under OPD).

The level of coverage differs from one plan to another. Some plans only cover expenses incurred on dental consultation or optical treatment in network hospitals, whereas others cover all forms of OPD. In the second table (What is covered under OPD), we have provided a brief listing of the coverage that different plans available in the market offer. The policies are for a 35-year-old male living in a metro city with no history of pre-existing diseases.

Should you buy an OPD cover? A typical OPD plan that would provide a benefit of, say, Rs 5,000 a year is usually Rs 4,000-4,500 costlier than a normal IPD (in-patient department) plan. Therefore, the decision to buy an OPD cover depends on how frequently you may have to use these services. Typically, families with young kids or older parents who have regular minor health issues may find these plans useful.

Universalising the OPD cover A fairly priced universal OPD plan that provides value to all kinds of customers can develop only when insurance companies develop a strongly administered network of OPD health care providers (clinics, diagnostic centres, medical shops, etc.). The biggest deterrent today for insurance companies who wish to offer such a plan is the pilferage, abuse and misuse of such benefits by a small section of customers and service providers. One way to make such a plan possible would be through the use of a cashless-only network, but that would require investment of significant time and effort by insurers.

)

)