LIC's premiums could be cheaper under new norms

However, it might continue to charge more than private sector players, especially for online term plans

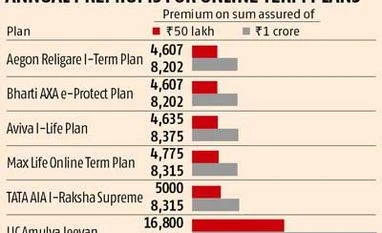

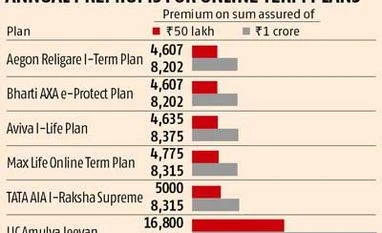

Priya Nair Mumbai From January 1, insurance premiums will go up by 12.36 per cent as service tax will be charged on these. They will also go up for term plans, the cheapest life insurance product available. Given that term plans are plain basic products, and there is no saving component, one would assume that the premiums would be pretty much same for all companies. But it is not so. They are the highest for Life Insurance Corporation (LIC), the largest in the segment.

LIC has currently discontinued its term plan, Amulya Jeevan, available only offline, as the company is in the process of re-filing products under the new guidelines for traditional products. It is possible that LIC’s premiums might come down under the new guidelines, as the revised products will be based on the new mortality tables, introduced last year.

Yet, the fact that LIC’s term plan is not available online is the biggest reason for it being more expensive than others.

A comparison of the premiums for a Rs 1-crore policy for a 30-year non-smoker male for a 30-year term plan proves this (see table). Premiums of term insurance are determined by distribution and operating cost, among other factors. Products that existed about four years ago, including term plans, were priced similarly. But once online term plans became popular, insurance companies started offering lower premiums on those, since it cut the paperwork significantly and reduced distribution costs for the companies, says Yashish Dahiya, chief executive officer, policybazar.com.

“Typically, those who buy term plans online are fairly well-educated and have a regular income. So, the mortality charges are lower and companies are finding it profitable to offer lower premiums,” Dahiya says.

Claims ratio, returns from investments and the projected future liability are some of the other factors that companies consider while fixing premiums, says Prakash Praharaj, founder and chief financial planner, Max Secure Financial Planners. “If the company is able to generate better returns on its investments it will offer lower premiums to customers,” he says.

Premiums can also vary depending on whether the customer is from the weaker section of the society or from rural areas, since mortality is higher in these cases. This is another reason why LIC’s premiums are high, since the bulk of their customers belong to this profile.

According to experts, the insurance behemoth is not able to offer term plans online due to strong opposition from agents. Until that happens, it is possible that premiums for term plans continue to be higher for LIC.

)

)