Recently, a foreign bank closed a deal for a Mumbai-based high net worth individual (HNI) who bought a school developed in Wakad (Pune). The developer built the school on two acres, after which the management decided to look for investors. The HNI invested Rs 20-25 crore; he is securing a yield of about 10 per cent.

While this investment required a couple of crores, not all investment deals are similar - the expenses depend on the type of property, city and the location.

There is high demand for social infrastructure properties such as schools and hospitals in areas where developers build townships. Sanjay Dutt, executive managing director (South Asia), Cushman & Wakefield, says, "If the commercial property is in a Tier-II or Tier-III city, the investment amount could be smaller, too."

While investments in real estate are aimed at diversifying one's portfolio, corrections across all property prices are forcing investors to think of an alternate diversification option within their real estate portfolios.

Experts say HNIs investing more than Rs 2 crore haven't made money; they haven't seen their investment double even in five years, a post-tax return of nine-10 per cent.

As investments in residential properties aren't very attractive anymore, individuals have started looking at commercial properties beyond just 'office spaces', in theme-based properties such as those for automated teller machines (ATMs), warehouses, industrial plots, private schools, hospitals, high-street shops, etc. Schools and hospitals could also be termed social infrastructure investments.

Anand Moorthy, head (real estate services), RBS Financial Services India, says, "These tenants have long-term interest in the property due to their nature of business and have typically higher lock-in period due to high capital and intellectual investment."

The trend started with the commercial segment seeing corrections due to over-supply; currently, this is down 40-50 per cent compared to 2008-09 levels. This was followed by compression in rental yields; now, yields are at all-time lows.

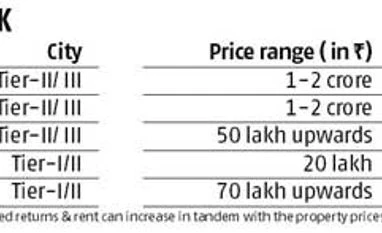

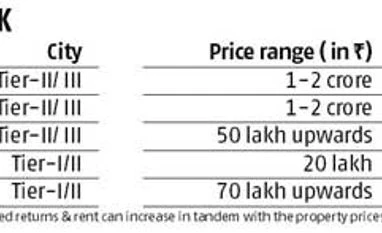

For investment in schools or hospitals, HNIs buy the property from a developer and enter into an agreement that assures him/her a guaranteed rent every month. In the case of a school, the rent would depend on the number of kids admitted to the school every year, while for hospitals, the number of beds would determine the rent. The management would be responsible for the rent, and this would be part of the cost of operation in their books of accounts. For such investments, most HNIs look at Tier-II and Tier-III cities. The demand for ATMs, warehouses and high-street shops is higher in Tier-I and Tier-II cities.

For such properties, the lock-in period is usually higher than that for office spaces. And, an investor may choose to stay invested for a period longer than the lock-in period. The lock-in period for ATMs and warehouses is usually three-five years; for hospitals and schools, it could be as high as eight-10 years.

Such alternative investment options are more relevant for those looking at long-term lock-in periods and expecting return on capital right from the first day. These are for people who seek regular income without taking the risk of vacancy. In case of office space, there is a risk of not being able to find a tenant after the annual contract expires.

The returns depend on the asset one invests in and the area he/she buys the property in. The segment is not standardised and has no established returns, unlike residential and office properties. "Schools, hospitals and warehouses have less chances of being shifted, unlike an office property. Here, yields are seven-nine per cent. Also, there is an assurance the rent will increase," says Moorthy of RBS. Returns from a school/hospital in a tier-II city would be different from one in a tier-III city. "Typically, bank ATMs give returns of 10-14 per cent. Two bank ATMs in the same locality could record different rents, depending on the bank," says Mudassir Zaidi, regional head (north), Knight Frank. He adds the rent earned from a foreign or private bank ATM could be different from that earned from a cooperative bank ATM.

To invest in such themes, one would require at least Rs 1 crore, depending on the property. You could buy an ATM space in a location such as Bandra for Rs 80 lakh, while for a couple of crores, you could buy a small educational institute/school in a Tier-II/III city. Prices of warehouses start at about Rs 50 lakh.

"Investments in such properties have their pros and cons. One of the plus points here is it has no development risk because most of the time, you are directly buying a ready-to-possess property. Therefore, no time is wasted in securing regulatory approvals from the state government authorities concerned. Using agricultural land for a hospital or a school is comparatively easier," says Dutt of Cushman & Wakefield.

Considering this is comparatively a high-ticket investment, one has to be cautious. Usually, HNIs don't pay regular visits to these properties. However, one should do so to be in sync with how the school/hospital is functioning. While the investor's rent doesn't depend on the profits of the firm, a closer look would help them know the status of the school/hospital.

Have a comprehensive agreement and ensure it is read by legal experts and property consultants so that there are no gaps in the draft. Don't confuse tenure with the lock-in mentioned in the agreement - while lock-in is the period you would have to be invested, tenure is the period you have opted for or the period you may choose to be invested. "Next, for capital value calculations, the rent receivables should be net of taxes (property tax and service tax) and common area expenses. Also stamp duty and brokerage cost need to be considered while working out realistic returns, so make sure you have factored in all those expenses before agreeing on the final price. In addition, make sure the fit-outs are done by the 'lessee' with some indication of the capital expenditure and that they are of good quality. Confirm the security deposit you will be liable to keep and how much will be the increase in rent every year," adds Moorthy.

)

)