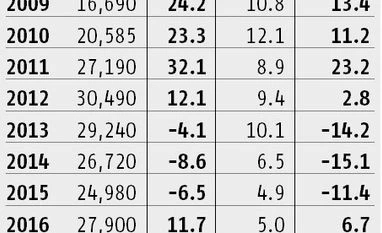

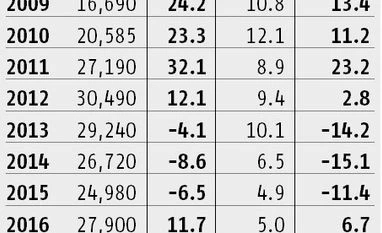

Physical gold has been favoured by investors since time immemorial. Even today, many investors buy one or two gold coins every month — their version of a systematic investment plan – and sit tight. There are several arguments in favour of buying gold. It is a hedge against inflation, a store of value, a safe investment avenue, and so on. However, things seem to be changing over the past few years. With consumer price index-based inflation dropping consistently, gold prices haven’t moved much, leading to a loss in terms of inflation-adjusted returns. For example, inflation has slipped from over 10 per cent in 2013 to 3.2 per cent (January-May 2017 average). In comparison, gold stood at Rs 30,490 per 10g in 2012 and is below Rs 29,000 currently.

In the past five years, barring one occasion, the inflation-adjusted return from gold has been negative. As a result, the investment demand for gold has halved from 350 tonnes a year earlier, over the past decade. Even the demand for jewellery has declined in recent times.

Bearish sentiment globally: The primary reason for the yellow metal’s underperformance is that the global economy is no longer in the midst of a crisis. According to Jean-François Lambert, founder, Lambert Commodities, a London-based firm, “Overall, good news for the world and for the dollar is not very good news for gold investors.”

Traditionally. gold has acted as a shield against economic and geopolitical uncertainty. “The economy is getting better. Potential geopolitical crises are possible but have so far been largely ignored by the markets. Further interest hikes by the (US) Fed will keep the dollar strong. Even India and China’s physical demand, which is half of the global gold demand, continues to be lower. All this means there is no support for gold from anywhere,” said Lambert.

Even central banks have been purchasing less gold. “Central bankers’ main concern is the lack of inflation, hence they have been undertaking Quantitative Easing to boost spending, by increasing liquidity. No or low inflation means the relative performance of gold versus inflation is largely irrelevant,” said Lambert. In its March 2017 quarterly demand report, the World Gold Council (WGC) said: “There has been a 27 per cent decline in gold demand from central banks from the 104.1 tonnes seen in Q1 of 2016. Gold demand from central banks has broadly slowed since the peak of 174.9 tonnes in mid-2014. The lower rate of purchases is likely to continue in 2017.”

GST and tougher compliance norms: For Indians, gold has always been a liquid asset that could be easily exchanged for cash at a short notice. However, changing taxation policies and compliance norms mean this might no longer be possible.

Until now, selling a small quantity of gold, say, 50g, has never been an issue. One could go to a scrap dealer, who would check the purity of gold and pay you instantly. Now, he will ask for purchase bills, which he will require when he sells the old gold to a jeweller. Sellers will also have to give their PAN numbers. Also, the sale of old gold will attract 3 per cent goods and services tax (GST). Says a Mumbai-based scrap gold dealer: “Neither do customers have the bills to show purchases and nor do we have that kind of cash. GST will make it more difficult for us to deal in unaccounted old gold.” In other words, unaccounted old gold will no more be any-time money that one can rely on in times of crisis. Proceeds from the sale will also come in the form of a cheque or bank transfer.

Invest for diversification: Investment advisors have, however, still not lost their faith in gold. They suggest investing a small part of the portfolio in the yellow metal for diversification.

Gold investment demand in India in 2016 calendar year was 161.7 tonnes. In the March quarter of 2017, it was only 31.2 tonnes, according to WGC data. From July on, imposition of three per cent GST will make gold costlier and parking unaccounted cash in gold will also become difficult. P R Somasundaram, India managing director at the WGC, had said earlier that it would take a year or so for the gold market to stabilise and adjust to GST. Adds Sanjeev Agarwal, who heads business chamber Ficci’s bullion committee: “Investment in gold will stabilise at lower levels.”

Bhargav Vaidya, a Mumbai-based bullion analyst, advises that investors not regard gold as an investment avenue that will offer attractive returns over time but as a store of value. “Gold will never perform like Infosys shares. It is a saving that you should keep separate from your business capital and from your expense account. It can also provide streedhan security,” he says.

Also, the government can’t demonetise gold, as it can do with currency. It also remains a useful asset in times of global or currency crisis. Says Vaidya: “In such times, it is the only currency that is accepted universally.”

How to invest in gold? Investors should hold 8-12 per cent of their portfolio in gold. The next question is whether to invest in physical gold or as sovereign gold bonds (SGBs). In the worst case scenario, such as war (when exchanges can stop functioning), physical gold is a better option. In most other circumstances, sovereign gold bonds are a better choice. Hence, diversify between physical gold and SGBs.

SGBs should be bought and held until they mature in eight years. Physical gold will attract 3 per cent GST and hence will cost more. But SGBs will not attract this levy. Buying these in demat form eliminates security risk. They also pay an annual return of 2.5 per cent on the initial amount invested. Most experts don’t expect returns from gold to improve in the near term. Some, however, have a more optimistic view. Says Surendra Mehta, secretary, Indian Bullion and Jewellers Association: “Business has not been good in recent times due to the effect of demonetisation. But, the current price level is favourable for purchase. Within 45 days of GST taking effect, when the festival season starts, good times will return for the industry.” He sees gold reaching $1,400 per ounce, 13 per cent up from its current level in due course, though not immediately.

)

)