Top funds beat benchmarks in a bear market

If you have laggards, stop allocating fresh money to them and watch their performance for three quarters

Sanjay Kumar Singh When the markets are down, fund managers can't possibly give you positive returns. But, if they manage to contain the downside risk - net asset values of funds declining less than the benchmark index - then they have done a good job.

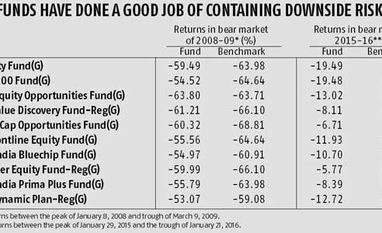

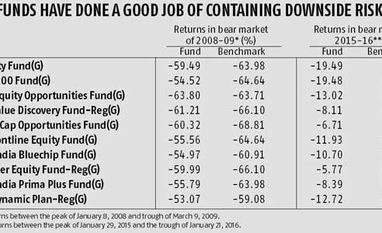

Most mutual fund managers across categories have managed to contain the downside risk in the current bear market. From the peak of January 29, 2015, to the trough of January 22, 2016, the Sensex dropped 19.27 per cent. In all equity fund categories, most funds have declined less than their respective benchmarks over this period.

We also ran the numbers to see how the top 10 funds by assets under management (AUM) have fared. Here, too, the results are satisfying. Barring two funds, the other eight have managed to beat their benchmarks in the current bear market. In 2008, only one fund had underperformed by a margin of 90 basis points. But there are two caveats.

One, these are point-to-point returns, which contain what is known as recency bias (tendency to be affected by what has happened in the recent past). Investors should also look at rolling returns, which have the ability to avoid this bias. If rolling returns are not available, they should look at the performance in five or more calendar years (which would encompass a couple of bear markets) to assess a fund's ability to deal with bear markets.

Two, these numbers also suffer from what is known as survivorship bias. Many funds would have been closed down or merged due to their poor performance. Hence, their performance doesn't get reflected in these numbers.

What does it mean? These figures indicate fund managers have done a reasonably good job of containing downside risk in the current bear market. Investors, especially those who entered the market in the post-election bull run, and are experiencing their first bear market, should not get disillusioned. Active fund managers' performance in this bear market bolsters the case for apportioning a significant part of your portfolio to active (as opposed to passive) funds.

Biggest funds have fared well The 10 funds with the highest AUM have done a good job of containing the downside risk both in the current market and in 2008. Experts offer several reasons for this. One, the largest schemes have stable fund management teams. Many of their fund managers have experienced multiple bull and bear markets and have become adept at managing these cycles. Two, the larger schemes have been around for a long time and enjoy goodwill among investors. They get a constant inflow of money through systematic investment plans (SIPs) even in a bear market. Faced with redemption pressure, they can use these inflows to pay investors who wish to exit. Smaller funds sometimes have to sell stocks in bear markets and this affects their performance. Larger funds also reap the benefit of having lower expense ratios.

Despite these figures, do not conclude that only funds with large AUMs do a good job of risk protection. "Many smaller-sized funds also manage to offer sound downside protection in bear markets," says Vidya Bala, head of research, Fundsindia.com.

What to do with laggards? If your fund has underperformed over the past year, stop fresh infusions into the scheme through SIPs. Put the fund on your watch list for at least three quarters and keep an eye on its performance. "Allow a long cooling period, especially in case of funds that have a good long-term track record. The fund manager may have bought a set of stocks that are underperforming currently because the market is not according them their due valuation. Such anomalies get corrected in due course," says Vishal Dhawan, chief financial planner, Plan Ahead Wealth Advisors. If the underperformance continues even after a year, exit the fund. While doing so, be mindful of exit load and tax implications.

Don't exit large-cap funds In this bear market, mid-cap funds have outperformed large-cap funds. Even large-cap funds that have taken some mid-cap exposure have done better than pure large-cap funds. Before you exit a large-cap fund, examine the reason for its underperformance. Don't punish a large-cap fund just for being true to its mandate.

If you look at tables of past performance, many multi- and mid-cap funds will feature at the top. Don't make the mistake of replacing the large-cap funds in your portfolio with multi- and mid-cap funds. Valuations of mid-caps are higher than they should be in a risk-off environment. Such high valuations could well lead to underperformance in the near future. Maintain a portfolio diversified across market caps. Don't chase past performance, lest you could end up investing in yesterday's winners and tomorrow's losers.

Say no to high cash calls

How a fund managed to protect downside risk is also important. "Check whether the fund achieved this while staying invested in equities or by moving into cash in a big way," says Bala. When the equity markets had bounced back after March 2009, funds that had remained invested in equities benefited from the upturn. Those that had gone into cash lagged behind.

According to experts, wealth is generated over a five- or 10-year period by containing declines.

If a fund falls sharply, say by 50 per cent, it has to rise by 100 per cent to get back to its original level. That is why, downside risk protection is a crucial aspect of fund management.

)

)