Bank recapitalisation critical for recovery, lending to aid growth: BofAML

The government unveiled Rs 2.11 lakh crore two-year road map for strengthening NPA-hit public sector banks, which includes re-capitalisation bonds, budgetary support, and equity dilution

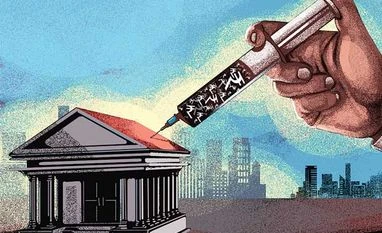

Press Trust of India New Delhi Bank recapitalisation is "critical" for the economic recovery of the country as it will step up lending which in turn will aid growth numbers, says a report.

According to a research report by Bank of America Merrill Lynch (BofAML), "bank recapitalisation is a sin qua non (an essential condition) for recovery.... It will step up lending, and, therefore, growth, step up tax collections and partly bring down the fiscal deficit".

The government yesterday unveiled a Rs 2.11 lakh crore two-year road map for strengthening NPA-hit public sector banks, which includes re-capitalisation bonds, budgetary support, and equity dilution.

"This (capital infusion in PSBs) will pull down lending rates, spur aggregate demand, put idle factories to work, exhaust capacity and spark investment in 2-3 years," the report said.

The capital infusion of PSBs entails mobilisation of capital, with maximum allocation in the current year, to the tune of about Rs 2,11,000 crore over the next two years, through budgetary provisions of Rs 18,139 crore, and recapitalisation bonds to the tune of Rs 1.35 lakh crore.

"This should help PSU banks heal their broken balance sheets and meet adequate capital requirements. Once growth recovers, the government can gradually convert these recap bonds into normal G-secs and sell them to the market, as happened in the past," the report said.

On Reserve Bank's monetary policy stance, the report said that the RBI is likely to cut rates by 25 bps on December 6 to signal lending rate cuts before the 'busy' industrial season intensifies in December.

The RBI, in its policy review meet on October 4, kept benchmark interest rate unchanged on fears of rising inflation while lowering growth forecast to 6.7 per cent for the current fiscal.

)