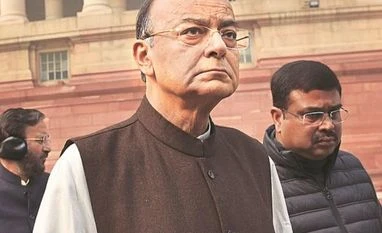

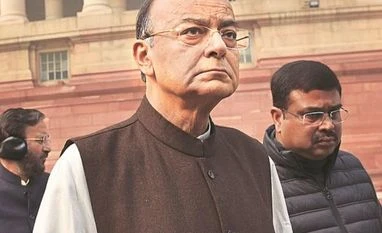

Global factors to be blamed for rupee depreciation, says Arun Jaitley

Also trade war between the US and China impacts a major currency in the Asian region, and therefore that creates an upheaval in the region, he said

)

Explore Business Standard

Also trade war between the US and China impacts a major currency in the Asian region, and therefore that creates an upheaval in the region, he said

)

Finance Minister Arun Jaitley Monday blamed the depreciation of rupee to a combination of global factors, including trade war and internal policy decisions of the United States.

After the government on Friday evening announced five-pronged strategy to deal with the slide in currency and widening current account deficit (CAD), the Indian rupee Monday plunged 67 paise to end at 72.51 against the US dollar. The rupee had plunged to a low of 72.70 to a dollar in intra-day trade.

It had closed at a one-week high of 71.84 on Friday.

To a question on the rupee depreciating Monday, Jaitley said: "These are impact of significant global phenomena which are going on. You have at least three, if not more, indications globally coming of what are the nature of things that are happening."

Elaborating further, the minister said the crude oil prices are increasing as there has been a squeeze on oil production which has upset the demand-supply ratio.

Also trade war between the US and China impacts a major currency in the Asian region, and therefore that creates an upheaval in the region, he said.

"And third of course is the internal decisions of the US along with some of these decisions which are leading to further strengthening of dollar. So if you see the dollar index early morning today, it significantly strengthened and that had a significant impact on currencies in the region," Jaitley said.

The five-pronged steps taken by the government to arrest fall in rupee include removal of withholding tax on Masala bonds, relaxation for foreign portfolio investments, curbs on non-essential imports.

First Published: Sep 17 2018 | 8:30 PM IST