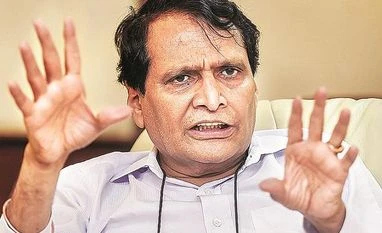

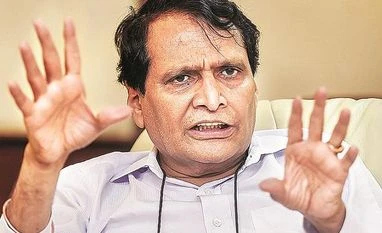

Need to create conducive environment for young entrepreneurs: Prabhu

The statement assumes significance as the government is working on support measures for startups that are raising concerns over angel tax issues

)

Explore Business Standard

The statement assumes significance as the government is working on support measures for startups that are raising concerns over angel tax issues

)

Commerce and Industry Minister Suresh Prabhu Saturday said there is a need to create a conducive environment and bring changes in old regulations to promote budding entrepreneurs.

"Had a fireside chat with the startups from Maharashtra and regulators on one platform. As entrepreneurship blooms, we need to create a conducive environment for our young entrepreneurs and bring changes in old regulations to catch up with technological changes," he said in a tweet.

The statement assumes significance as the government is working on support measures for startups that are raising concerns over angel tax issues.

The government is contemplating hike in the investment limit for availing income tax concessions by startups and provide a more clear definition for the purpose.

Giving relief to budding entrepreneurs last year, the government allowed startups to avail tax concession only if total investment, including funding from angel investors, does not exceed Rs 10 crore.

Officials of the department for promotion of industry and internal trade (DPIIT) and Central Board of Direct Taxes (CBDT) are holding series of meetings to find a solution of the angel tax issue being raised by startups.

Though startups are demanding complete exemption from this tax, the government is considering to increase investment limit for tax exemption to Rs 25-50 crore.

The discussions for support measures come against the backdrop of various startups raising concerns on notices sent to them under the Section 56(2)(viib) of the Income Tax Act to pay taxes on angel funds they have received.

The section provides that the amount raised by a startup in excess of its fair market value would be deemed as income from other sources and would be taxed at 30 per cent.

Touted as an anti-abuse measure, this section was introduced in 2012. It is dubbed as angel tax due to its impact on investments made by angel investors in startup ventures.

Last month, the government eased the procedure for seeking income tax exemption by startups on investments from angel funds and prescribed a 45-day deadline for a decision on such applications.

First Published: Feb 09 2019 | 8:45 PM IST