Registered firms have better access to short-term finance

The analysis indicates that registered partnership firms have better access to short-term finance, as compared to their unregistered counterparts

Business Standard New Delhi CRISIL has analysed 7,000 micro, small, and medium enterprises (MSMEs) established as partnership or proprietorship firms and rated on the basis of their 2013-14 financials (financial year April 1-March 31), with a view to understanding whether there is a correlation between their registration with the State Registrar of Firms and their access to short-term finance (i.e. working capital).

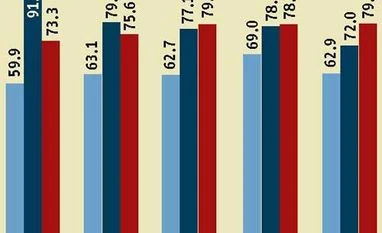

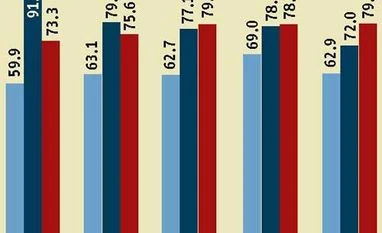

The analysis indicates that registered partnership firms have better access to short-term finance, as compared to their unregistered counterparts. In the sample analysed, 49 per cent of working capital for registered partnership firms comes from banks, as against 37 per cent for unregistered partnership firms. Proprietorship firms, for which there is no such equal authority, score the lowest, with 33 per cent of their working capital coming from banks. Registered firms have an edge over unregistered firms, as the dependence of registered partnership firms on promoter funding for their working capital needs is significantly lower at 16 per cent, than that of unregistered partnership firms at 29 per cent and proprietorship firms at 25 per cent.

Registration seems to strengthen the firm's image among lenders; CRISIL believes that a higher level of transparency and availability of credit information places them in a better position to attract funding for growth. Government initiatives to simplify the business registration process will encourage firms to register themselves with the State Registrar, thus benefitting the overall performance of MSMEs.

Note: This fortnightly tracker presents to our readers insights on MSMEs, a key element of the Indian economy. CRISIL has rated over 75,000 MSMEs in India. The analysis is based on the latest audited financial statements (i.e. 2013-14) of CRISIL-rated MSMEs. Most enterprises finalise their audited financials for the previous financial year by the end of the second quarter of the current one.

)

)