The transition for the Indian railways from having a separate Budget for itself to becoming a part of the Union Budget could not have come at a more inopportune time. This is for several reasons.

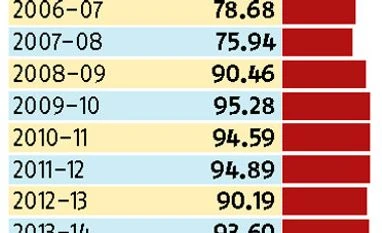

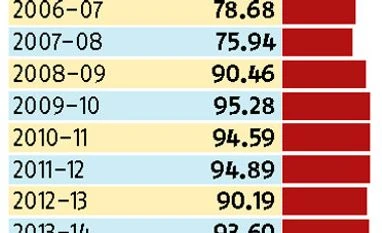

One, the railways are in extremely poor financial health. The operating ratio (gross operating expenses to gross earnings) is expected to touch a low of 94.9 per cent in the current financial year. Even if this revised estimate figure holds, which it may not, it means that virtually all that the railways earn is gobbled up by meeting its running expenses, thus leaving precious little for investment from its own resources. Expenses have shot up because of the government’s decision to implement the Seventh Pay Commission’s recommendations during the current financial year.

While a pay commission is set up around once in a decade and thus contributes to only a periodic spurt in expenses (after that there is a plateauing out at a higher level), earnings should follow a steady upward trajectory. It is here that the situation is most disturbing. For the first time in its history, the railways are set to end the year (2016-17) with freight loadings not just missing the target set for the year but actually going down to 1,093 million tonnes form the 1,101 million tonnes achieved in the previous year (2015-16). This has obviously had an impact on earnings which are set to miss the target by 9 per cent or a massive Rs 17,000 crore.

No end of trouble The secular trend in the railways’ earnings is so disappointing that none expects the national carrier’s performance to improve in the coming financial year (2017-18). Hence the operating ratio for the year has been set at 94.6 per cent, virtually the same as that in the current year.

The second reason why the transition is ill-timed is because lately the railways have witnessed a string of accidents. To set things right, what is needed is focused handling enabled by both financial resources and management attention. The predominant cause of these appears to be derailment, which points to aging railway tracks giving up because they have not been replaced on time. The last time an arrear in track renewal built up, the government of the day sought to set it right by creating a Special Railways Safety Fund (SRSF). Consequently in 2001 the so called first SRSF was created and allocated Rs 17,000 crore. This was made up of Rs 12,000 crore from the central government and Rs 5,000 crore from the railways themselves by levying a safety surcharge.

Taking note of the need for renewal and safety, the government has announced in the Budget the creating of a Rs 1 lakh crore Rashtriya Rail Sanraksha Kosh or SRSF2 which will be spent over five years. The figure is impressive but under current conditions is likely to remain only on paper. This is because the government or the general exchequer is to provide only a bit of “seed capital” and the railways will have to arrange the “balance resources from their own revenues and other sources.” But where will the railways’ own resources come from when the operating ratio is so high and, according to the railways own expectations, likely to remain so? Borrowing will bring in some resources but at a high cost. Servicing such borrowing will eat into resources available for investment further.

One way out will be to levy a safety surcharge but that is another name for raising passenger fares. The scope for raising either passenger fares or freight rates is severely limited by the stagnation in traffic (number of passengers actually went down over a period and freight tonnage now seems to be similarly headed). What this has done is made infructuous one reform that has long been sought: setting up an independent authority to fix fares and freights so that these do not fall prey to populism or bad economics.

In fact, the stagnation in traffic is the result of the railways’ inability to introduce the much-needed reform so that it becomes an agile organisation which can align itself to the market imperatives. The railways need to move away from catering to the needs of bulk commodities like coal, iron ore, steel and grain. Several decades ago, in order to reap the economies of scale in carrying bulk cargo, the railways had switched to booking entire rakes of individual commodities. So the whole institution of marshalling yards where individual wagons were taken out of one formation and joined to another declined in importance.

Today, the need is not just to shift emphasis to dealing in terms of wagons but smaller loads like parcels and to pick up such loads from the shipper’s doorstep and deliver it at the customer’s doorstep. For this, not only will marshalling yards have to become important again but logistical parks have to come up next to these to offer storage in transit for cargo of a wagon-load or less. The government seems to have absorbed the message but got mixed up halfway.

The Budget speech does well to speak of the need for “end to end integrated transport solutions” but then falls down by adding “for select commodities”.

It goes on to speak of customised facilities to carry “perishable goods, especially agricultural products.” Are we talking of fresh fruits and vegetables before efficiently handling washing machines, or is it just poor drafting?

The absence of clarity in marketing points to the serious management deficit: the railways’ inability to reorganise itself along customer segments instead of persisting with the present function-oriented structure.

In need of an overhaul

It is vital to have Railway Board members for customer segments like goods and passengers and not just technical functions like infrastructure and traction. But this has not yet happened. In fact, the greatest need is for the railways to become a new animal by abolishing the multitude of officers’ cadres and opt for an integrated setup like an Indian Railway Service. This will put an end to the bane of the railways: operating in silos aligned with the interests of individual cadres. The ultimate folly of this setup is to have a low-powered Railway Board chairman who is somewhat similar to the non-executive chairman of a company. Any difference between two sectional-interest-oriented board members leads to the item in question being held over. What is needed is for the chairman to be empowered to act like a CEO who can overrule differences and hand down decisions which have to be implemented.

What we have is the worst kind of stop-gap-ism with the chairman getting a longish extension. The management deficit goes deeper. The end of the railway Budget has acted as a mood depressant among senior railway officials, according to a veteran who prefers to remain anonymous. There is a sense of having become faceless and a feeling that “this is no longer our baby for whom we will be held directly accountable. We are now part of an indistinguishable crowd.”

Ending the railway Budget would have made sense if it was promptly followed by corporatisation. There is no reason why the railways cannot function like a Steel Authority of India or a Bharat Heavy Electricals, which publish quarterly results and are accountable, no matter how notionally, to public shareholders through stock listing. Corporatisation would have made it a professional commercial entity. Instead of moving towards greater disclosure through corporatisation, the demise of the railway Budget has led to lower disclosure. All the information contained in the traditional railway Budget papers was promised but that has not happened till the time of writing. As another old railway hand wryly commented, “Perhaps, there is much to hide.”

The one reform that would have at least told us where the railways actually stand, publishing of accrual-based accounts, has been promised only in 2019, after being in the works for years. A huge public asset is being depreciated by political ad-hoc-ism even as accidents keep getting more frequent.

)

)