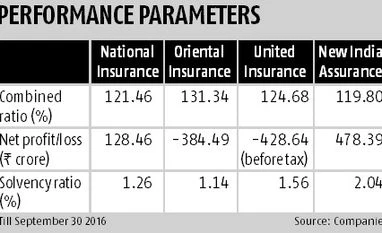

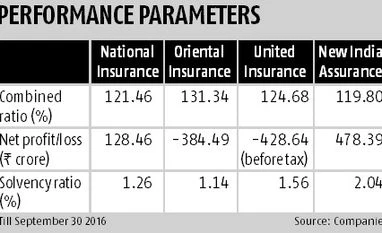

Public sector insurance firms planning to list face high claim and solvency ratios and falling profitability. National Insurance and Oriental Insurance have solvency ratios below the required 1.50 per cent and United India and Oriental Insurance reported recent losses. New India Assurance and National Insurance, too, have seen a fall in profitability.

Investments of public sector general insurance companies stood at Rs 122,650 crore at the end of March 31, 2016, almost double the investments made by private sector companies. However, the state-owned companies are not allowed to account for these in their solvency ratios.

The market share of public sector general insurance companies fell from 57 per cent in 2010 to 50 per cent in the first half of 2016-17, according to ICRA. Private insurers have been aggressive in capturing the retail market, which has led to an increase in their market share.

“When liberalisation happened, the retail market was one area where the public sector insurance companies were not strong and the private sector captured this space,” said Sanjay Datta, chief, underwriting and claims, ICICI Lombard General Insurance.

Areas in which public sector companies have a major market share have high claims ratios. An increase in natural calamities over the years has added to their woes as well. National Insurance had to take a hit of around Rs 80 crore over the Chennai floods.

Motor insurance is the largest non-life segment with a share of 44 per cent, in which both private and public sector companies are aggressive. The area of concern for public sector companies is the health portfolio, which accounts for nearly 29 per cent of the market.

In health insurance, public sector companies have nearly 64 per cent of the market. This segment has the highest claim ratio in the industry at 98.43 per cent, followed by the motor segment at 81.18 per cent, according to IRDA.

The share of private insurers in health declined from 27 per cent in 2011-12 to 20 per cent in 2015-16, while the share of public sector general insurers increased from 61 per cent to 64 per cent. In the health portfolio, group health insurance, which accounts for 48 per cent, has been a grey area for most insurers.

"Public sector general insurance companies are competitive when it comes to large risk and pricing. However, if pricing becomes too competitive and it does not cover the costs, then it hits the operating margin of the company. It is a double-edged sword, one can use it as a competitive tool, but not to the extent that it starts hurting one’s finances,” said Datta.

National Insurance posted an 85 per cent drop in net profit to Rs 149 crore in 2015-16. The company's solvency ratio was 1.26 per cent, below the regulatory requirement of 1.50 per cent. “We have been representing to the regulator that our off-balance sheet strength, like real estate and fair value, should be considered in calculating the solvency ratio,” said K Sanath Kumar, CMD, National Insurance.

)

)