Yet liberal Democrats, inspired by Senator Elizabeth Warren’s focus on wealth inequality and distrust of big banks, are intent on getting like-minded officials into those jobs. They argue that in a Democratic administration, the president must pick regulators with strong records of prioritizing average Americans over financial titans.

“Personnel is policy,” and progressives have come into the fight “armed with a bazooka,” said Stephen Myrow, managing partner of Beacon Policy Advisors, a Washington-based firm that tracks regulatory and legislative proposals. “You will certainly see some re-regulation.”

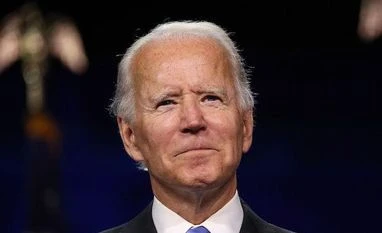

Hanging in the balance could be the reach of post-crisis rules that were eased during the Trump administration. Over the past four years, adjustments to complex requirements like capital levels, collateral for derivatives trades and brokers’ legal responsibilities have saved banks tens of billions of dollars. Firms are also concerned there will be a fresh focus on investigations, a clampdown on executive pay and that regulators will be slow to lift restrictions on dividends and share buybacks that were implemented due to the pandemic.Biden has already tapped former Commodity Futures Trading Commission Chairman Gary Gensler and KeyBank NA executive Don Graves to examine financial regulatory agencies as part of the presidential transition, according to a person familiar with the matter. Gensler’s role should appease progressives, as he gained a reputation for standing up to Wall Street during President Barack Obama’s administration. Conversely, the involvement of a long-time banker like Graves will probably reassure financial firms.

)