Deloitte survey: CFOs pitch for more capex in Budget

Majority also okay with some deferring of fiscal consolidation schedule

BS Reporter New Delhi

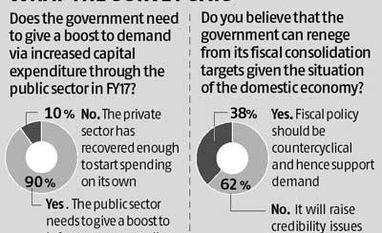

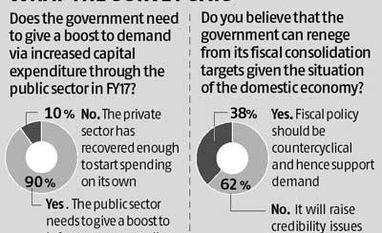

A majority of respondents in a survey by global consultancy Deloitte want more government spending on infrastructure in the coming Union Budget (to be presented on February 29). And, deferring of the earlier schedule for fiscal consolidation, it says.

About 90 per cent want higher infra spending; 62 per cent also want fiscal consolidation. A majority suggest the government take a longer time route for the target of a fiscal deficit no larger than three per cent of gross domestic product. The present schedule calls for 3.5 per cent in 2016-17, from 3.9 per cent in this current financial year, and then to three per cent in 2017-18.

This might be a challenge, with the outgo for implementing the 7th pay commission report for government employees and the 'one rank, one pension' decision for ex-military personnel. Last year, Finance Minister Arun Jaitley had said he was deferring the road map by a year. The earlier schedule was for cutting the deficit to 3.6 per cent this financial year and to three per cent by 2016-17.

However, most respondents to the survey, covering 130 tax executives and finance head of companies, also concede that diverting from this schedule will raise credibility issues for the government.

Anis Chakravarty, partner, Deloitte Touche Tohmatsu India, said: “Our survey shows an overwhelming majority of respondents believe a boost to infrastructure is the need of the hour and that some change in the consolidation plan, with focus on the quality of spending, is welcome.” He said a revival in investment and consolidation are not mutually exclusive. “Fiscal consolidation is a path the government has embarked on and some slippage on account of boosting infra spend and catering to insufficient demand in the economy might be beneficial,” he said. With the state of the private sector, the survey said, capital expenditure by the government has been low.

A majority were confident of Indian economic prospects in the light of a slowing Chinese economy, with 52 per cent believing growth here is primarily determined by domestic prospects.

About 30 per cent favour an increase in the basic exemption limit for personal income tax from Rs 2.5 lakh to Rs 3 lakh a year. A majority feels individual tax rates should be brought down over time, with exemptions or deductions being phased out. Jaitley is supposed to announce a schedule in this regard for corporate tax, coupled with a reduction in the corporate tax rate to 25 per cent from the present 30 per cent over four years.

“Fifty eight per cent of the respondents agree complete phase-out of tax incentives is a good measure and will reduce litigation. Interestingly, 22 per cent agree that instead of phasing out incentives for the infrastructure sector, it should continue in the form of a investment-linked tax incentive,” said the survey report. Given the industry pressures and recent announcement of tax incentives for start-ups, complete phase-out of these looks difficult, it said. On service tax, 19 per cent favoured an increase in the rate to 16 per cent from the current 14 per cent; 17 per cent backed an increase to 15 per cent. And, 43 per cent wanted the Swachh Bharat cess to be subsumed in service tax, with a rate of 14.5 per cent.

)

)