Did you know that the central government runs eight employment schemes through seven ministries? Or, there are already five types of digital India schemes run by five departments?

These and many more such examples would have been difficult to figure out through the dense clutter of numbers that Budgets produce. It has only now become possible to cut through the clutter, because of the massive expenditure budget rejig carried out this year. It has made the entire jungle of government expenditure visible to anyone. It also shows how departments have often duplicated each other’s work, leading to a sizeable wastage of government money.

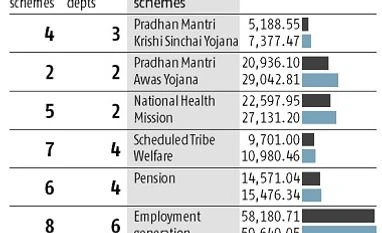

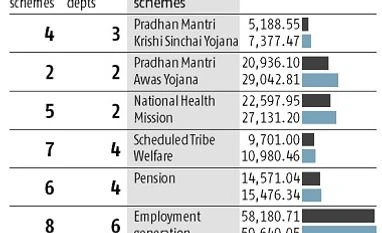

The sums involved are massive. For instance, the eight employment schemes between them will eat up Rs 59,640 crore, the same as the current year’s expenditure for development of roads. The largest chunk is, of course, for the scheme under the Mahatma Gandhi National Rural Employment Guarantee Act at Rs 48,000 crore. But there are seven others, too, with considerable budgets.

These include the Technology Upgradation Scheme of the ministry of textiles with a purse of Rs 2,924.6 crore and the Pradhan Mantri Rozgar Protsahan Yojana run by the ministry of labour at Rs 1,164.9 crore. The smallest of them is ASPIRE, a scheme to train micro and small scale enterprises, at Rs 50 crore. It is surprising what a scheme with such a puny budget could actually aspire to.

The clubbing of the schemes on the basis of what their key deliverables are has been undertaken by the department of expenditure in the finance ministry. It is a courageous exercise, as every department in the government extracts funds by demonstrating how unique they are. Yet as statement 3B of the expenditure budget shows most of them are fairly similar. Almost all the 100-odd centrally sponsored schemes can thus be drawn into a tight group of 15 categories, as the table shows.

“Till last year, nobody knew of this. The only way for anyone outside the government to measure if a scheme was doing well was to check how well it had spent the money,” says Sunil Sinha, Principal Economist at India Ratings.

‘

The table has been introduced in Budget FY 18. In terms of holding up a mirror to the scale of wastage in government expenditure, it could soon become similar to the Receipts Foregone table that shows how much tax the government has lost out on through exemptions.

The new classification structure in the first part of the two volume Expenditure Budget also shows how fast bad habits spread within the government. Digitisation had just taken root in the Centre but, already, there are five departments at work on centrally sponsored schemes to spread it. Between them, they have a budget of Rs 1,356 crore. It was Rs 1,745 crore in the Budget Estimate last year but has got crimped this year. The departments besides Information Technology include Panchayati Raj, Lad Resources, School Education and that of Higher Education.

Similarly, insurance schemes for various sections of the population ought to be administered by the department of financial resources. But the Rs 10,810-crore budget for the same for FY18 is to be spent by three more departments, including commerce, agriculture and the department of health and family welfare. It is interesting that while the domain knowledge for the insurance sector, including the regulator, sits within the department of financial services, it is the department of agriculture which runs the largest funding programme for it — the Pradhan Mantri Fasal Bima Yojana with a budget of Rs 9,000 crore for FY18.

Even the benefits for Scheduled Tribes, which one would expect to be integrated under the ministry of tribal affairs, has got spread out. The sum involved is Rs 10,980.46 crore. Of this, a third is spent by the tribal affairs ministry under three categories of centrally sponsored schemes. These are the special central assistance at Rs 1,350 crore, tribal education at Rs 1,635 crore and Vanbandhu Kalyan Yojana at Rs 505 crore. The rest is partly spent by the ministry for development of the Northeast. The splitting of the schemes is a key reason why the benefits are far less than the scale of expenditure. An officer of the department of the expenditure said none of the departments share the details of their working with others. Sinha added the exercise should be followed up by rationalisation of workforce and schemes to live up to the maxim Minimum Government, Maximum Governance.

Instead, in the current framework, the schemes work at cross-purposes. Worse, since the states draw their funding from the different centrally sponsored schemes, they are not keen to point to the similar nature of them and ask them to be merged.

)

)