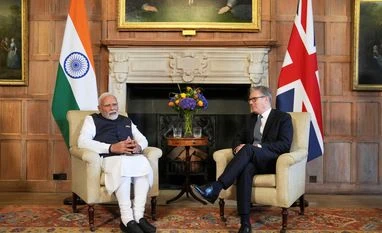

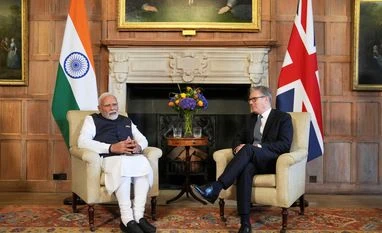

India likely to forego ₹4,060 crore in first year of UK trade pact: GTRI

The India-UK free trade agreement, which was signed on July 24, will lead to a loss of customs revenue for both the countries

)

Explore Business Standard

Associate Sponsors

Co-sponsor

The India-UK free trade agreement, which was signed on July 24, will lead to a loss of customs revenue for both the countries

)

India is expected to forego customs revenue of ₹4,060 crore in the first year of the free trade agreement with the UK, as tariffs are reduced or eliminated on a wide range of goods, think tank Global Trade Research Initiative (GTRI) said on Monday.

The calculation is based on the current import figures from the UK.

By the tenth year, it said, as tariff elimination phases-in more broadly, the annual loss is projected to rise to Rs 6,345 crore or around British Pound 574 million, based on FY2025 trade volumes.

The India-UK free trade agreement, which was signed on July 24, will lead to a loss of customs revenue for both the countries, as tariffs are reduced or eliminated on a wide range of goods, GTRI added.

India imported USD 8.6 billion worth of goods from the UK in 2024-25.

Industrial products make up the bulk of these imports and face a weighted average tariff of 9.2 per cent.

Most agricultural products, subject to much higher average tariffs of 64.3 per cent, were excluded from tariff cuts, except for items like whisky and gin.

It said that India has committed to eliminating tariffs on 64 per cent of the value of imports from the UK immediately as the implantation starts.

Overall, India will eliminate tariffs on 85 per cent of tariff lines and reduce tariff on 5 per cent of tariff lines or product categories.

"Based on these factors, India's revenue foregone in the first year of the agreement is estimated at Rs 4,060 crore," GTRI Founder Ajay Srivastava said.

He added that the UK imported USD 14.5 billion worth of goods from India in the last fiscal year, with a weighted average import tariff of 3.3 per cent.

Under the comprehensive economic and trade agreement (CETA), the UK has agreed to eliminate tariffs on 99 per cent of Indian imports.

"This translates to an estimated annual revenue loss of British Pound 375 million (or USD 474 million or Rs 3,884 crore) for the UK, again based on FY2025 trade data. As Indian exports to the UK expand, the fiscal impact is likely to grow over time," it said.

The implementation of the pact may take about a year as it requires approval from the UK parliament.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

First Published: Jul 28 2025 | 2:10 PM IST