Budget 2018: Arun Jaitley delivers a realistic mixed bag on the tax front

There has been moderate relief on both the personal and corporate tax fronts, apart from incentives for start-ups

)

premium

graph

Direct taxes

The finance minister (FM) presented Budget 2018 in the backdrop of high expectations on tax relief on both the personal and corporate fronts. He delivered a realistic mixed bag on the tax front.

Welcome measures for personal tax

Senior citizens

Medical and interest exemption limits proposed to be enhanced (Table 1)

Salaried class

Standard deduction of up to Rs 40,000 is introduced. It will however subsume the existing medical reimbursement (Rs 15,000) and transport allowance (Rs 19,200). Effective additional deduction will be Rs 5,800, though the entire deduction will be allowed without submitting any evidence for the claim. See comparison with other countries. (Table 2). The provision can be made inflation adjustable.

NPS

Now, all subscribers will be entitled to exemption on withdrawal of up to 40 per cent of the corpus.

Corporate tax

The beneficial tax rate of 25 per cent brought in last year for MSMEs with turnover of up to Rs 500 million will be extended to companies with turnover of up to Rs 2.5 billion (in FY 2016-17). Effective tax rates for companies and firms are shown in Table 3.

The proposal should fuel employment-generating investments. However, the benefit could be extended to LLP/firms. New MSME companies (set up after FY 2016-17) will not benefit. Further, retaining the 30 per cent rate for large corporates may affect FDI, given the rate reduction in other countries (Table 4).

Tax incentives to start-ups

Continuing to incentivise startups, the seven-year tax holiday is now extended to startups incorporated up to March 31, 2021 (an extension of two years). Further, the tax exemption will also be available to start-ups engaged in scalable business models with high potential for employment generation and wealth creation. However, a turnover cap of Rs 250 million is to be maintained for seven initial years. This may restrict effectiveness. The proposal is encouraging but we have some way to go. (See Table 5 for ranking.) Start-ups could also be exempted from tax on investments by angel investors.

Syncronising tax laws with emerging trends

‘Business connection’ expanded -- Non-residents were hitherto taxed for business carried on through physical presence. To bring the digital economy into the tax net, non-residents with ‘significant economic presence’ will be considered to have a taxable presence through business connection. Significant economic presence could be created through business of sale of goods/provision of service, electronic data/software downloads. Foreign entities engaged in app-based business, cloud services, digital advertisements earning substantial income from India will be impacted. This provision, giving precedence to substance over form, may largely be ineffective until definitions of Permanent Establishment under the tax treaties are aligned with this. There may also be overlapping, in practice, with the equalisation levy. A credit mechanism may be brought in to avoid double taxation.

As per BEPS Action Plans, India has signed the Multilateral Tax Treaty Convention (MLI). The scope of Dependent Agent Permanent Establishment (DAPE) is expanded under some tax treaties. Under the proposed DAPE rules, any dependent person habitually negotiating contracts on behalf of a non-resident would create agency PE, even without concluding the contract. Further, MLI also has provisions to disregard fragmentation of activities by non-residents to avoid creating PE in India. The domestic law is now synchronised with the MLI with expansion of “business connection” as above. While the proposed amendment follows the global trend, it may be difficult in practice to establish the extent of any person’s involvement in negotiating contracts.

Taxation of capital gains and dividend

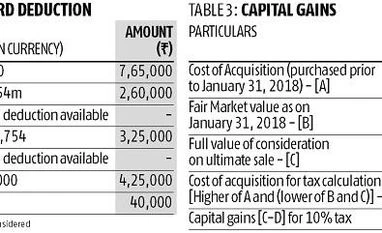

Long Term Capital Gains (LTCG) tax on listed shares – Henceforth, LTCG exceeding Rs 100,000 per year on disposal of equity shares and units of equity-oriented mutual funds through the stock exchanges will suffer LTCG tax at 10 per cent (without indexation benefit). However, capital gains accruing on investments till January 31, 2018 will be grandfathered.

(See Table 3 for illustrative LTCG scenarios.) This proposal will affect the buoyancy of the stock markets in the short term, though not affecting small investors. The concessional tax of 10 per cent will only apply where both acquisition and transfer are subject to STT. This can pose challenges for genuine off-market transactions. Treaty shopping by foreign investors may get revived, though GAAR can be a deterrent. Economics-wise, the move may deter people from looking at equity as a mode of long-term investment. As an alternative, the threshold of LTCG holding could be increased to three years and exemption retained.

To ensure a level playing field, FIIs will also be covered under the LTCG tax rate of 10 per cent and grandfathering.

Accumulated profit of amalgamating companies

To prevent tax planning through amalgamation/capital reduction, DDT will also be levied on distribution by the amalgamated company from accumulated profits brought in by the amalgamating company (whether capitalised or not).

Facilitating insolvency resolution

Rationalisation measures

The seasonal benefit has now been extended to the footwear and leather industry. This is a welcome proposal. However, the intended benefit of employment generation may get restricted by the emolument cap. Additionally, the IT/ITES sector, facing challenges owing to the emergence of artificial intelligence, robotics and internalisation policies of other countries could do with incentives for employee re-skilling.

Safe harbour introduced for taxing the variation from stamp duty values

Presently, in computing income on transfer of immovable property, the higher of two values (sale consideration or stamp duty value) is adopted. Such difference in value is taxed both in the hands of purchaser and seller. Considering the fact that property valuation involves a certain degree of estimation based on various factors, a tolerance limit of five per cent of the sale consideration has been brought into the law to avoid adjustment in genuine cases. Five per cent is too small compared to the actual deviation, which is mostly as high as 30 per cent.

Conversion of stock-in-trade into capital asset

Currently, conversion of capital asset into stock-in-trade is taxable but not vice-versa. Conversion of stock-in-trade to capital assets will now attract taxes. This move will discourage the practice of converting shares held as stock-in-trade into investments, to claim benefit of lower or nil tax on capital gains.

Investment in LTCG exempting bonds restricted

Currently, capital gains arising on transfer of any long-term capital asset is exempted if such gain is invested in specified bonds within six months. The benefit will be restricted only to LTCG on transfer of land and/or buildings. Further, bonds have to be held for five years (currently three years).

Overriding judicial precedents

Taxation of capital receipts

Compensation received for termination/modification of business contracts and employment contracts is now taxable as business income and income from other sources respectively. However, capital receipts were not taxable. Henceforth, capital receipts will also be taxed, thus unsettling well-settled judicial precedence. The practice of amendments overriding judicial precedents continues.

Country by Country Report (CbCR)

The CbCR-furnishing deadline has been relaxed for Indian outbound groups and inbound entities of foreign MNCs. CbCR will now be filed within 12 months from the end of the reporting accounting year, as against the present deadline, which is concurrent with the deadline for filing tax returns (i.e. November 30). This modification will align Indian regulations with global best practices and should be extended for master file filing also. Further, the Finance Bill clarifies that the inbound entity of the foreign group needs to file the CbCR even in cases where CbCR regulations have not been enacted in the parent jurisdiction. This will create an additional burden for MNCs and can be difficult, practically.

Paradigm shift

Unique Entity Number (UEN)

The government is now intending to use PAN as UEN for business enterprises. Data security can be a matter of concern for both.

Other key proposals

MAT not applicable for foreign companies having only presumptive income taxation;

The finance minister (FM) presented Budget 2018 in the backdrop of high expectations on tax relief on both the personal and corporate fronts. He delivered a realistic mixed bag on the tax front.

Welcome measures for personal tax

Senior citizens

Medical and interest exemption limits proposed to be enhanced (Table 1)

Salaried class

Standard deduction of up to Rs 40,000 is introduced. It will however subsume the existing medical reimbursement (Rs 15,000) and transport allowance (Rs 19,200). Effective additional deduction will be Rs 5,800, though the entire deduction will be allowed without submitting any evidence for the claim. See comparison with other countries. (Table 2). The provision can be made inflation adjustable.

NPS

Now, all subscribers will be entitled to exemption on withdrawal of up to 40 per cent of the corpus.

Corporate tax

The beneficial tax rate of 25 per cent brought in last year for MSMEs with turnover of up to Rs 500 million will be extended to companies with turnover of up to Rs 2.5 billion (in FY 2016-17). Effective tax rates for companies and firms are shown in Table 3.

The proposal should fuel employment-generating investments. However, the benefit could be extended to LLP/firms. New MSME companies (set up after FY 2016-17) will not benefit. Further, retaining the 30 per cent rate for large corporates may affect FDI, given the rate reduction in other countries (Table 4).

Tax incentives to start-ups

Continuing to incentivise startups, the seven-year tax holiday is now extended to startups incorporated up to March 31, 2021 (an extension of two years). Further, the tax exemption will also be available to start-ups engaged in scalable business models with high potential for employment generation and wealth creation. However, a turnover cap of Rs 250 million is to be maintained for seven initial years. This may restrict effectiveness. The proposal is encouraging but we have some way to go. (See Table 5 for ranking.) Start-ups could also be exempted from tax on investments by angel investors.

Syncronising tax laws with emerging trends

‘Business connection’ expanded -- Non-residents were hitherto taxed for business carried on through physical presence. To bring the digital economy into the tax net, non-residents with ‘significant economic presence’ will be considered to have a taxable presence through business connection. Significant economic presence could be created through business of sale of goods/provision of service, electronic data/software downloads. Foreign entities engaged in app-based business, cloud services, digital advertisements earning substantial income from India will be impacted. This provision, giving precedence to substance over form, may largely be ineffective until definitions of Permanent Establishment under the tax treaties are aligned with this. There may also be overlapping, in practice, with the equalisation levy. A credit mechanism may be brought in to avoid double taxation.

As per BEPS Action Plans, India has signed the Multilateral Tax Treaty Convention (MLI). The scope of Dependent Agent Permanent Establishment (DAPE) is expanded under some tax treaties. Under the proposed DAPE rules, any dependent person habitually negotiating contracts on behalf of a non-resident would create agency PE, even without concluding the contract. Further, MLI also has provisions to disregard fragmentation of activities by non-residents to avoid creating PE in India. The domestic law is now synchronised with the MLI with expansion of “business connection” as above. While the proposed amendment follows the global trend, it may be difficult in practice to establish the extent of any person’s involvement in negotiating contracts.

Taxation of capital gains and dividend

Long Term Capital Gains (LTCG) tax on listed shares – Henceforth, LTCG exceeding Rs 100,000 per year on disposal of equity shares and units of equity-oriented mutual funds through the stock exchanges will suffer LTCG tax at 10 per cent (without indexation benefit). However, capital gains accruing on investments till January 31, 2018 will be grandfathered.

(See Table 3 for illustrative LTCG scenarios.) This proposal will affect the buoyancy of the stock markets in the short term, though not affecting small investors. The concessional tax of 10 per cent will only apply where both acquisition and transfer are subject to STT. This can pose challenges for genuine off-market transactions. Treaty shopping by foreign investors may get revived, though GAAR can be a deterrent. Economics-wise, the move may deter people from looking at equity as a mode of long-term investment. As an alternative, the threshold of LTCG holding could be increased to three years and exemption retained.

To ensure a level playing field, FIIs will also be covered under the LTCG tax rate of 10 per cent and grandfathering.

- DDT on loan to substantial shareholders of private companies

- DDT for equity-oriented mutual funds

Accumulated profit of amalgamating companies

To prevent tax planning through amalgamation/capital reduction, DDT will also be levied on distribution by the amalgamated company from accumulated profits brought in by the amalgamating company (whether capitalised or not).

Facilitating insolvency resolution

- Relief to companies undergoing insolvency/bankruptcy proceedings

Rationalisation measures

- Weighted deduction for additional hiring

The seasonal benefit has now been extended to the footwear and leather industry. This is a welcome proposal. However, the intended benefit of employment generation may get restricted by the emolument cap. Additionally, the IT/ITES sector, facing challenges owing to the emergence of artificial intelligence, robotics and internalisation policies of other countries could do with incentives for employee re-skilling.

Safe harbour introduced for taxing the variation from stamp duty values

Presently, in computing income on transfer of immovable property, the higher of two values (sale consideration or stamp duty value) is adopted. Such difference in value is taxed both in the hands of purchaser and seller. Considering the fact that property valuation involves a certain degree of estimation based on various factors, a tolerance limit of five per cent of the sale consideration has been brought into the law to avoid adjustment in genuine cases. Five per cent is too small compared to the actual deviation, which is mostly as high as 30 per cent.

Conversion of stock-in-trade into capital asset

Currently, conversion of capital asset into stock-in-trade is taxable but not vice-versa. Conversion of stock-in-trade to capital assets will now attract taxes. This move will discourage the practice of converting shares held as stock-in-trade into investments, to claim benefit of lower or nil tax on capital gains.

Investment in LTCG exempting bonds restricted

Currently, capital gains arising on transfer of any long-term capital asset is exempted if such gain is invested in specified bonds within six months. The benefit will be restricted only to LTCG on transfer of land and/or buildings. Further, bonds have to be held for five years (currently three years).

Overriding judicial precedents

- Income Computation and Disclosure Standards (ICDS)

Taxation of capital receipts

Compensation received for termination/modification of business contracts and employment contracts is now taxable as business income and income from other sources respectively. However, capital receipts were not taxable. Henceforth, capital receipts will also be taxed, thus unsettling well-settled judicial precedence. The practice of amendments overriding judicial precedents continues.

Country by Country Report (CbCR)

The CbCR-furnishing deadline has been relaxed for Indian outbound groups and inbound entities of foreign MNCs. CbCR will now be filed within 12 months from the end of the reporting accounting year, as against the present deadline, which is concurrent with the deadline for filing tax returns (i.e. November 30). This modification will align Indian regulations with global best practices and should be extended for master file filing also. Further, the Finance Bill clarifies that the inbound entity of the foreign group needs to file the CbCR even in cases where CbCR regulations have not been enacted in the parent jurisdiction. This will create an additional burden for MNCs and can be difficult, practically.

Paradigm shift

- E-assessment

- For greater efficiency and transparency and to reduce the interface between the tax payer and department, all assessments (except in notified cases) will be conducted through the electronic medium. The faceless and nameless e-assessment procedure is expected to reduce compliance cost and instill confidence among honest taxpayers. Infrastructure readiness of the tax department can pose a challenge for this mammoth initiative.

Unique Entity Number (UEN)

The government is now intending to use PAN as UEN for business enterprises. Data security can be a matter of concern for both.

Other key proposals

MAT not applicable for foreign companies having only presumptive income taxation;

- Transfer of property between holding and subsidiary companies below market value exempted from tax avoidance mischief;

- Exempted trusts to suffer tax for cash payments (higher than Rs 10,000) and on non-withholding of tax;

- Chapter VIA-C deductions only if return filed within due date;

- No prima facie adjustment for gap between income as per return and TDS statement;

- Prosecution would lie for non-filing of return even without any tax liability.

graph

graph

Graph