Budget focus on tax administration reforms

Most measures to benefit govt's programmes but more could have been done, <b>says a PwC analysis</b>

)

premium

Last Updated : Feb 03 2017 | 1:03 AM IST

Direct tax provisions

Budget 2017 was presented in the backdrop of several momentous global events and the government’s demonetisation initiative. The finance minister’s theme of “Transform, Energise and Clean India”, in tax terms, translated into measures to address tax avoidance, a fillip to the ease of doing business, a focus on infrastructure (primarily real estate), and tax administration reforms.

Some key tax proposals are discussed below.

Digital economy and “less cash” economy

- Cash payments

The Budget lays out measures to nudge the country towards a “more digital” and “less cash” economy. Earlier, cash payments for revenue expenditure in excess of Rs 20,000 were disallowed. This limit will be reduced to Rs 10,000. The disallowance has been extended to certain categories of capital expenditure incurred in cash in excess of Rs 10,000. Effectively, this could result in the government collecting taxes from the payor (through the tax impact of the disallowance) in addition to the recipient.

Recipients of cash in excess of Rs 3 lakh from a person in a day or in respect of a single transaction/transactions relating to one event or occasion will be subject to an equivalent penalty.

- Presumptive taxation

A six per cent presumptive rate on turnover/receipts received through banking channels will be applied to small businesses with turnover not exceeding Rs 2 crore. This could result in reduction of the tax rate by 25 per cent on non-cash transactions, when compared with the existing presumptive rate of eight per cent.

Anti-tax avoidance measures

- Limitation on interest deductions

Following BEPS Action Plan 4, a new section is proposed to limit interest deductions claimed by Indian companies or Indian Permanent Establishments of foreign companies. Interest deductions on payments to non-resident associated enterprises (exceeding Rs 1 crore) would be restricted to 30 per cent of EBITDA, with the balance being eligible to be carried forward. Interest payments to third party lenders are also covered, where the underlying debt is backed by an implicit or explicit guarantee or equivalent deposit from overseas associated enterprises. Banks and insurance companies are excluded (Table 1).

This will create additional tax outflow for Indian companies (even in the case of third party loans). This appears contrary to the government’s move to encourage ECBs through a continued reduction of the withholding tax rate on ECB interest and disregards the arm’s length principle even for genuine transactions.

- Place of effective management

PoEM rules to determine tax residency of corporates are applicable from 2016-17. While recent principles issued by the CBDT on PoEM are a welcome move, some issues need to be addressed on priority. Unless there is specific clarity on various aspects of PoEM, it may hinder the ability of Indian companies to go global. CFC rules could have been considered as an alternative.

- GAAR

After several deferrals, GAAR will apply from April 1, 2017. CBDT recently issued clarifications to address several concerns on GAAR. Implementation of the rules on the ground needs to be uniform, fair and rational, as promised by the CBDT. With this move, India will join a league of countries that have statutory GAAR (Table 2).

- Transfer for inadequate consideration

Receipt of money or property without consideration/for inadequate consideration will be taxed to the recipient, thereby extending the current provisions to firms and private companies. This will essentially limit transactions such as “gifts” in the corporate context.

- Reference to fair market value

Section 50CA has been inserted, which will require consideration on sale of shares to be at FMV for computing capital gains. Third party transactions also appear to be covered, resulting in the requirement of taxpayers to justify negotiated third party sale prices. The government must also prescribe unambiguous guidelines and time limits for determining such FMV to eliminate any subjectivity.

Real estate

The Budget has provided relief to developers under the affordable housing scheme (which grants 100 per cent deduction on profits) by extending the period for completion of the project to five years (from three years), with carpet area (instead of built-up area) to be used for determining eligibility.

With demonetisation impacting real estate sales, the holding period for treating immovable property as long-term has been reduced from three years to two. This could lead to creation of a secondary market and consequent reduction in prices. Section 54EC is being expanded to provide exemption for investments made in certain bonds to be notified.

Notional tax will be charged on unsold inventory only after one year from completion, implying that it could have otherwise been taxable. This may lead to a litigious situation as most real estate players adopt a no-tax position on stock-in-trade.

Tax treatment of joint development agreements has been clarified, with tax to be levied in the financial year when the certificate of completion is issued and not in the year in which possession of the land was transferred.

Ease of doing business

- Indirect transfers

Acknowledging India as a preferred investment destination among emerging markets for FPIs (Table 3) and the uncertainty caused by the indirect transfer rules, investments in FPI (Category I and II) will be exempt from indirect transfer provisions retrospectively from April 1, 2011. The Finance Bill does not appear to contain a clarification on exempting overseas redemptions of shares by private equity players where the underlying shares had been sold in India previously. A clarification in this regard would be welcome.

- Conversion of preference shares

Conversion of preference shares into equity shares will not result in a taxable event. The period of holding and cost of acquisition will date back to the original purchase of the preference share. This amendment will bring parity amongst various classes of convertible instruments. Being a clarificatory amendment, this could have been made retrospective.

- Tax rates

The peak tax rate for companies with turnover less than Rs 50 crore will be reduced to 25 per cent (Table 4). While this will result in a cash flow benefit for MSMEs, it could create some disparities. (Table 5). LLPs will continue to be a tax-friendly vehicle for doing business (Table 6).

- Start-ups

Eligible start-ups will be allowed a tax holiday for any three years in the first seven years (previously five years) of their existence. This should help many start-ups faced with losses in the initial years. Start-ups will be allowed to carry forward and set off losses incurred in the first seven years only if all shareholders holding shares in the year losses are incurred continue to hold these shares in the year the losses are set off.

- Specified domestic transactions

The transfer pricing compliance burden will reduce, as payments to specified persons such as directors, parent and sister companies, etc would be excluded from domestic transfer pricing provisions with effect from FY 2016-17. Domestic transfer pricing provisions will now only cover inter-company and intra-company transactions, where one or both the parties/units are involved in activities eligible for tax holidays.

- MAT

Amendments are proposed to the MAT provisions to synchronise them with IND-AS. With IND-AS bringing in a paradigm shift in how companies maintain their accounts, this clarity on MAT treatment will add to the government’s tax-friendly approach.

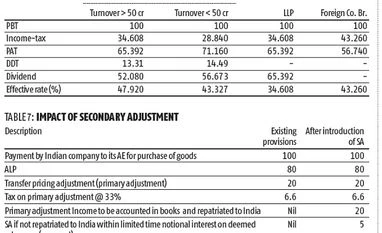

Secondary adjustments

Indian companies will need to bring into their books, and repatriate into India, the difference between the transaction price and arm’s length price. Failure to do so will result in imputation of interest on such amounts (secondary adjustment).

The secondary adjustment will be applied where there is an adjustment to transfer price either through the taxpayer making a suo moto adjustment, accepting a transfer pricing adjustment made during assessment, accepting a safe harbour or an APA or MAP resolution. See Table 7 for the impact of this provision.

This principle has been applied during many recently concluded MAP and APA cases. Subsequent repatriation by the Indian company of such amounts brought into India will be subject to DDT.

Personal Tax

- Tax rates

While tax slabs for individuals remain unchanged, tax rates for income between Rs 250,000 and Rs 500,000 have been reduced from 10 per cent to five per cent. This results in a tax saving of Rs 12,875 (including cess) for taxpayers with income exceeding Rs 500,000 and a reduction of about 50 per cent in the case of individuals with income below Rs 500,000.

Rebate for low-income earners (section 87A) is reduced to Rs 2,500, from the present limit of Rs 5,000, and will be available only where income does not exceed Rs 350,000.

The maximum marginal rate for income between Rs 50 lakh and Rs 1 crore will now be 33.99 per cent, and for income above Rs 1 crore it will remain at 35.54 per cent.

These moves should address the issue of the “missing middle” (taxpayers with income between Rs 2 lakh and Rs 5 lakh with a low compliance ratio) as recognised by the Report of the Task Force on Direct Taxes headed by Dr Vijay Kelkar.

- Long-term capital asset

The base year for cost inflation index has been advanced to 2001 from 1981.

- Loss from house property

The set-off of loss from house property will be limited to Rs 2 lakh, with the balance eligible to be carried forward for eight years.

- Other key measures

Equity shares in a company or unit of an equity-oriented fund (subject to exclusions to be notified) acquired on or after October 1, 2004, on which STT has not been paid on the purchase, will be taxed as long-term capital gains. Currently, capital gains on the transfer of such shares/units are exempt from tax, if the sale transaction is subject to STT.

Timelines for assessments will be progressively reduced. Hopefully, this should not lead to hurried assessments. Simplified tax filing measures are tried and tested, and should be well received.

Conclusion

The proposals present a mixed bag for taxpayers. Many measures will lend impetus to the government’s initiatives, but more could have been done in some areas.

Kaushik Mukerjee

Partner – Direct Tax, PwC India

Team members: E N Dwaraknath, Saurav Bhattacharya, Subhasis De, Madhawi Rathi, Gaurav Kumar Goyal, Amithraj N, Prajwala Pai, Sandesh Kumar, Tejas Shah, Bharat A, Monika Baid, Aman Hada, Sandeep K, Natarajan S, Santhosh S