After posting a dismal performance in the first quarter of the current fiscal year, fast moving consumer goods (FMCG) company, Emami Ltd is expecting a 14-15 per cent volume growth for the remaining nine months of the current year, which will translate into a 17-18 per cent topline growth during this aforesaid period.

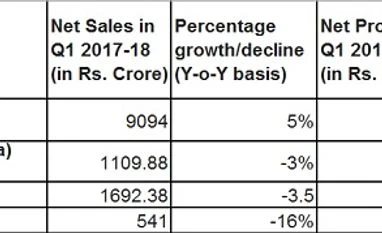

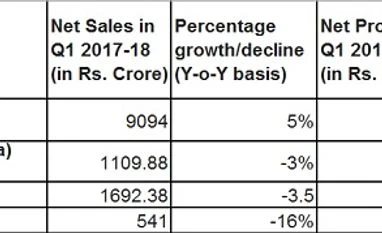

In wake of the Goods and Services Tax (GST) implementation, amidst its peers, Emami Ltd bore the brunt as over 50 per cent of its sales are routed through the wholesale channels, which had resorted to serious destocking with stocks piling up with the dealers. As a result, company sales volume fell which direly impacted the top line by 16 per cent and the bottom line by over 98 per cent. In the Q1 period, the company barely managed to post a meagre Rs 1 crore of net profit.

While both Hindustan Lever and Colgate-Palmolive could post a growth in their net profit, both Marico and Emami Ltd’s bottom lines were hit. However, Emami Ltd fared the worst when compared to Marico whose net profit shrunk by 11.9 per cent while Emami Ltd’s profitability dipped by 98 per cent.

“We are quite confident, going forward in an overall year basis we will be able to grow in terms of net profit as well as the top line. GST has played a very big role in the decline of the top line and whatever top line decline has been there, it is due to destocking. The bottom line is the result of a reduction in the top line," company director Harsha V Agarwal said.

Analysts opine that the underlying demand and channel restocking should result in healthy earnings in the coming quarter.

“Restocking has started in all geographies and the wholesale (channel) recovered in the last 10 days of July," an analyst with a brokerage firm, Motilal Oswal said.

Abneesh Roy, research analyst at Edelweiss Securities is also optimism about the company’s near-term performance.

“I expect Emami to clock better growth going ahead, led by robust innovation pipeline, being a key beneficiary of rural recovery and reducing overall reliance on wholesale channel”, he said.

The company’s chairman, R S Agarwal, during his address to the shareholders in the recently concluded annual general meeting, said that the company has initiated the process to reduce its dependence on the wholesale channels and instead increase the emphasis on direct distribution which will help the company combat such disruptions better in days ahead.

In the last fiscal year, the company increased its direct distribution by 100,000 outlets to 730,000 outlets and now targets to ramp it up up to 800,000 in the current financial year.

Harsha is of the opinion that the wholesalers were unsure about how GST will impact them because of which the destocking took place.

“Now the apprehension has reduced and the trade has gone up but will take some time”, he said.

A second factor which resulted in Emami Ltd posting one of its worst quarterly performances ever was the stress of the international business.

A report from HDFC Securities stated that the international business, owing primarily to political and related issues in the Middle-East region and a reduction in channel inventory suffered a 19 per cent decline on a year-on-year basis.

“On account of slow recovery in some geographies, we reduced international business revenue CAGR to 15 per cent over FY17-20 against the 18 per cent projection earlier”, Naveen Trivedi, research analyst with HDFC Securities stated.

However, Agarwal said inventory correction in the international markets has been done and new launches in Bangladesh will help the company achieve better sales.

Although analysts predict a high double-digit sales volume growth rate for the remainder of the 2017-18 fiscal year, the stress in Q1 and projections over the international business is expected to bring the annual consolidated growth down to 7-8 per cent.

The major bet for the company this year is on its balm portfolio, Boroplus and Fair & Handsome which will lead the recovery and the estimated growth.

For the quarter ended June 31, 2017, Emami Ltd’s net profit fell by over 98 per cent at Rs. 1.04 crore while the top line toppled over 16 per cent at Rs. 541 crore. The net profit and net sales during the first quarter of the last fiscal year stood at Rs. 57 crore and 645 crore respectively.

)

)