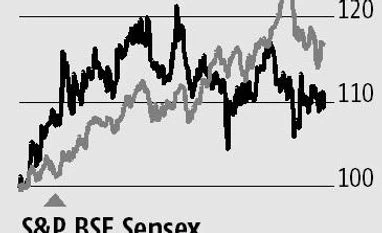

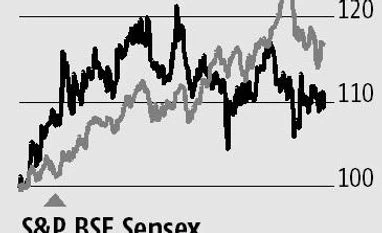

Shares of Marico underperformed the S&P BSE FMCG index and the S&P BSE Sensex in the last six months as sentiment turned sour due to input cost pressure.

The cost pressure marred the December 2017 quarter (Q3) performance of the country’s largest hair oil company.

The price of copra, a key raw material accounting for 45-50 per cent of its total raw material costs, has increased sharply in the previous quarters. Due to deficient north-east monsoon rainfall, copra prices were up 91 per cent year on year (y-o-y), in Q3.

Marico’s consolidated gross profit margin (gross profit, or the cost of goods sold, as percentage of net sales) contracted by 520 basis points (bps) y-o-y, and 50 bps sequentially. Gross margins moved south even for the company’s standalone business, which incorporates its India operations, including the Parachute and Saffola brands.

Though Marico has hiked prices by 11 per cent effective January 2018 (cumulative price hike of 20 per cent in FY18 to date), its gross profit margin is expected to remain under pressure in the next couple of quarters as copra prices are still higher than the year-ago level. “Copra prices are still on the higher side, therefore the price hikes will not be sufficient for an expansion in margin in Q4,” said Sachin Bobade, analyst at Dolat Capital.

The firm’s management has indicated that margin recovery is unlikely in the near term as copra prices are expected to soften after the next crop.

However, the silver lining is that despite the gross margin pain, Marico has gained market share in over 90 per cent of its product portfolio so far in FY18 and overall volumes grew 7.4 per cent in Q3 (partly due to the low base of last year). Marico has been able to substantially offset the gross profit margin pressure through cost-cutting measures. Ebitda (earnings before interest, tax, depreciation and amortisation) margins were down only 70 bps in Q3.

An email sent to Marico did not elicit any response. But Marico Managing Director and CEO Saugata Gupta told a news channel that it was okay to bear the margin pain in the short term, and as long as volume growth (expected to be 8-10 per cent) and market share were sustained, coupled with an aggressive cost management programme, the company should continue delivering margins of 17-18 per cent.

The Street, too, seems to be convinced, given that shares of Marico are now tracking overall markets in the last one month.

Analysts at Reliance Securities had said they expected Marico to report higher growth in the near term on account of trade stabilisation, recovery in rural growth, and robust volume growth, among others.

Against this backdrop, the worst may be behind Marico. Some analysts also see an upside in the medium term if copra prices stabilise or decline. Prices are down about 3 per cent sequentially in Q4 so far.

)

)