Buses, non-personal passenger cars to adopt electric mobility next: Report

India's first wave of electric mobility adoption has penetrated the two- and three-wheeler segments with a variety of new products

)

Explore Business Standard

India's first wave of electric mobility adoption has penetrated the two- and three-wheeler segments with a variety of new products

)

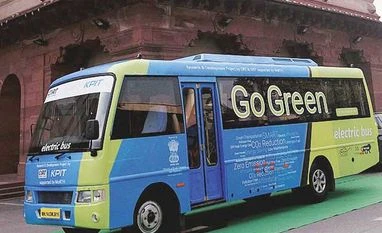

The next wave of electric mobility adoption is expected in segments such as buses and non-personal category of passenger cars, driven by factors like low-cost of ownership, policy push and environmental awareness, says a report.

According to global management consulting firm Kearney, with steps such as adequate infrastructure and appropriate business models, electric vehicle (EV) adoption can reach 25 to 30 per cent of new sales across segments by 2030.

India's first wave of electric mobility adoption has penetrated the two- and three-wheeler segments with a variety of new products.

In the next wave, vehicle segments such as buses and passenger cars in commercial applications will see a faster pace of electrification, driven by the improving total cost of ownership, environmental awareness, and a policy push, according to the whitepaper 'Electric mobility 2.0: tracking the next wave in India'.

Industry body, FICCI earlier this month recommended various measures to the government, including continuation of the FAME -II scheme till 2025, to enhance demand for electric vehicles amid severe disruption caused by Covid-19.

According to the report, the steps required to boost electric vehicle adoption include affordable products, standardisation of technologies, higher financial incentives, among others.

"Making electric vehicles a widespread phenomenon will require focus on suitable vehicle segments and applications, potential business models, supplier landscape along with the infrastructure and ecosystem surrounding this, said Manish Mathur, partner and head of Kearney's Asia Pacific Automotive, Transportation and Infrastructure Practice.

The original equipment manufacturers (OEMs) need to develop market-focused affordable offerings and educate customers about the value proposition of EVs.

EV manufacturers should also invest in local supplier development to reduce costs and create a robust after-sales network for superior customer service, the whitepaper stated, adding industry bodies should encourage shared investments for research and development along with knowledge transfer among members.

They should also drive the standardisation of technologies to minimize product and ecosystem development costs, it said.

According to Rahul Mishra, Kearney principal and electric mobility lead, the lockdown may have temporarily shifted focus away from the electrification agenda, "there are still a number of challenges to be addressed".

"The policy landscape across states is still not aligned, the total cost of ownership has not reached parity for many segments, and the choice of options and acquisition cost of available options are important drivers, he said.

Pitching for enhanced financial incentives by the Government to boost demand and provide fiscal and non-fiscal incentives for domestic manufacturing, the whitepaper said that this will reduce import dependence in the long run.

The current state of the economy and the thrust on self-dependence can catalyze this effort, it said.

"With adequate infrastructure development and appropriate business models, EV adoption by 2030 would require an additional 40 to 60 billion units (kWh) by 2030, constituting 2 to 3 per cent of the expected energy demand at that time.

"Although planned generation and core transmission capacities seem adequate for future growth, last mile distribution capacity should be assessed and augmented wherever required, said Bhaskar Rakshit, principal and power and utilities lead.

Already subscribed? Log in

Subscribe to read the full story →

3 Months

₹300/Month

1 Year

₹225/Month

2 Years

₹162/Month

Renews automatically, cancel anytime

Over 30 premium stories daily, handpicked by our editors

News, Games, Cooking, Audio, Wirecutter & The Athletic

Digital replica of our daily newspaper — with options to read, save, and share

Insights on markets, finance, politics, tech, and more delivered to your inbox

In-depth market analysis & insights with access to The Smart Investor

Repository of articles and publications dating back to 1997

Uninterrupted reading experience with no advertisements

Access Business Standard across devices — mobile, tablet, or PC, via web or app

First Published: Jul 22 2020 | 3:12 PM IST