Cairn's biz outlook could suffer after merger with Vedanta

Vedanta recently sweetened the deal for minority shareholders of Cairn India, increasing the chances of the merger being completed soon

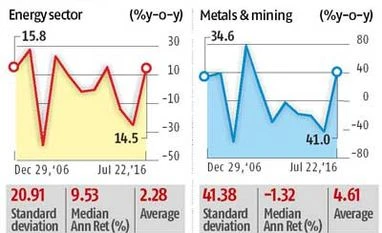

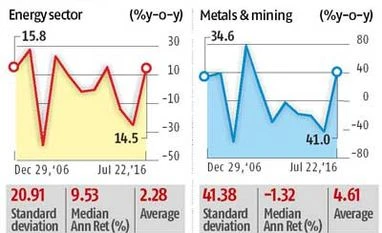

Aditi Divekar Mumbai Oil company Cairn India's business outlook might become more uncertain after its merger with metals major Vedanta because energy prices are less volatile than those of base metals.

Vedanta recently sweetened the deal for minority shareholders of Cairn India, increasing the chances of the merger being completed soon. Vedanta had announced the merger plan in mid-2015.

Anil Agarwal, founder and chairman of London-listed Vedanta Resources Plc, maintains the merger will create a diversified natural resources like Vale, Rio Tinto and BHP Billiton. Vedanta's metals business comprises aluminium, copper, lead and zinc and iron ore.

Historic trends in metals show all commodities follow the same cycle. The cartelised energy industry, on the other hand, faces less volatility than metals, says an analyst with an Indian brokerage firm.

In December 2008, the MSCI Energy Index, for instance, was down 39.4 per cent while the MSCI Metals and Minerals Index was down 55.9 per cent. In the previous year, the index for energy was up 27.5 per cent while metals and minerals rose a much higher 40.1 per cent.

The Organization of the Petroleum Exporting Countries controls about 80 per cent of the world's oil and nearly half the natural gas reserves. With supply controlled, energy prices are less volatile than metals, where there is no global cartel controlling prices.

"Due to stability in energy prices, costs can be estimated and this provides clarity on revenue, which in turn helps in better estimation of margins," says Giriraj Daga, investment manager, Visaria Securities.

Of late, China has become the big risk for metals. It is the world's largest producer and consumer of most base metals. A slowdown in China has led to a global glut in base metals.

In Vedanta's non-ferrous basket, zinc is the only metal with a strong price outlook, due to tight supply. Other base metals are trending weak, due to slack Chinese demand.

)

)