The keenly-watched cricket matches during India’s current tour of England follow the bumper viewership that FIFA World Cup Russia notched up in India. So is Sony Pictures Networks India’s (SPN) sports cluster — the broadcaster for the back-to-back tournaments and the Asian Games starting next week — ready to recover the ground it lost when STAR India won the global media rights for BCCI’s Indian Premier League (IPL) for 2018-22?

But before we answer that question, look at what’s at stake. Sports advertising revenue in India last year stood at Rs 73 billion, up from Rs 64 billion the previous year.

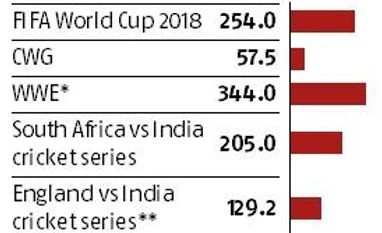

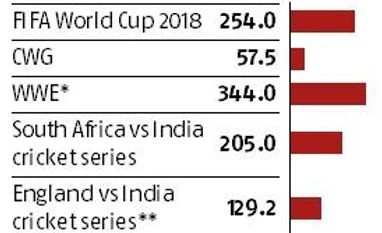

The network claims the viewership numbers for the football world cup were 254 million. That is the cumulative number for the live matches and repeats on the channels as well as on SPN’s OTT platform Sony LIV. Despite India not participating, the viewership for the final match between France and Croatia was 50 million. With four test matches left to be played, the England versus India series has been watched by nearly 129 million people so far.

High as that number might be, it is puny in comparison to what Sony lost this year. The IPL, reports suggest, got 1.4 billion impressions this year on Star network’s 17 channels and its OTT platform Hotstar. The league has taken this viewership to its new broadcaster which spent Rs 163.47 billion to end Sony’s decade-long, since-inception association with the cash-rich league. Also, IPL is an annual event unlike a football world cup.

Agree experts. Indranil Das Blah, the CEO of celebrity management firm Kwan Entertainment and Marketing Solutions, says while Sony has managed to get other cricket properties but even some marquee test series featuring India would not make an iota of what the IPL used to. Balu Nayar, former managing director at IMG, South Asia, who designed, marketed and monetised the IPL for the BCCI believes that it will be challenging for any broadcaster to fill the gap because “there is no TV sports property in the Indian market that comes anywhere close to the IPL”.

What is the road ahead for the 11 channels of the SPN? Which are the sporting events that would drive its revenues? Answering some of these questions, Rajesh Kaul, SPN’s chief revenue officer, distribution, and head, sports, says the network has a host of events lined up to help offset the IPL loss.

“Cricket of course is big for us. We have rights of cricket played virtually everywhere except in India. These include the top three cricket playing nations — Australia, England and South Africa. Tournaments such as Ashes or, say, an Australia-South Africa series are big in terms of advertising revenues. Then we telecast matches played in countries such as West Indies and Sri Lanka which also offer decent viewership in a cricket-loving country like India,” says Kaul.

It was recently that SPN acquired the broadcasting rights for England and Australia which was earlier with Star. More cricket through the year, according to Kaul, offers better leverage than the IPL, without having to spend as much on promotions.

“Sample this, we have 1,000 days of cricket to be shown over the next five years, 300 of them in the next one year itself. These are both India games and include big ticket non-India games as well. So instead of a 45-day event, we have people subscribing to our pay channel for longer durations which boosts the distribution business,” Kaul says.

While Star Sports refused to participate in this story, the IPL win offers the network many attendant advantages. According to Nayar, “Two other strategic advantages linked to the IPL rights are the revenues and clout with the traditional TV distribution of cable and DTH, and the ability to acquire paid subscribers on the channel’s OTT platform.”

Coming back to SPN, Kaul points out that WWE wrestling is the second-most viewed programme on sports channels in India after cricket, and Sony has the broadcasting rights to that as well. Realising how popular it had become in India, SPN introduced Hindi commentary in the last season and it has driven the numbers up further. “We are also looking forward to the Asian Games because if India does well, the numbers soar,” says Kaul. Asked about the tepid viewer response to the Commonwealth Games telecast on the network in April this year despite a decent show by the Indian contingent, Kaul says the channel was happy with the response though the numbers cannot be compared to cricket ratings.

The future, according to him, looks bright. “In the past three-four years, the viewership has been healthy in sports other than cricket. That is a good trend as we are a multi-sport network.”

All said, despite having a bouquet of channels, why hasn’t SPN been able to create an advertising property like Star’s Pro Kabaddi League (PKL)? Kaul says the response to the Pro Wrestling League on Sony “was encouraging and more programmes are on the anvil”.

The network’s OTT platform Sony LIV has also gained considerable ground with a range of live match telecast. Is that translating into revenue or eating into the TV pie? “For now, the free content includes sports matches with a five minute delay, but to watch live people have to pay. And if more people are willing to pay, it only strengthens distribution. Doesn’t it?,” Kaul signs off.

)

)