The recent surge in international coal prices and pet coke might be a boon for Coal India (CIL) as the miner can now expect better sales, particularly of high-grade coal.

Demand for domestic coal from power plants and cement companies has been on the rise. Imported coal prices have surged 30 per cent since June. Currently, imported thermal coal of 6,000 gross calorific value (GCV) costs $65 or Rs 4,348 a tonne on an average, while pet coke rose 73 per cent. In comparison, CIL’s coal of a similar grade is priced at Rs 3,000 for both the power and non-power sectors such as cement and steel.

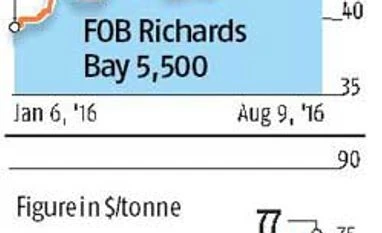

According to data provided by Platts, globally, thermal coal at FOB Richards Bay 5,500 kcal/kg went up from $39.5 in the beginning of the year to $53.3 at present. Similarly, pet coke prices rose from $45 to $77. India’s total landed cost is much higher.

“Following the increase in imported coal prices and the government’s push to increase sales of indigenous coal, consumers now will be interested in higher purchases of Indian coal,” said a senior CIL official.

CIL now also sends coal to the ports from where deliveries to the consumers can be made either through inland waterways or the maritime route. A higher offtake will imply CIL increasing production. During April-July, the miner had lagged six per cent to its targeted production of 173 million tonnes (mt). However, the production in absolute terms is higher by four per cent. The offtake situation was further dismal as only 89 per cent of the 196 mt target could be achieved.

Deepak Kannan, managing editor, Asia Thermal Coal, S&P Global Platts, said: “Indian cement companies, which had previously shifted to using petroleum coke, or pet coke, amid attractive prices are now expected to revert to buying thermal coal. Unlike previously expected, Indian demand has not been strong, however, as domestic coal availability has improved and Coal India's production is on a rise. With monsoon season ending in September, Indian buyers are expected to come back into the market mid-to-late August to re-stock, but they face significantly higher prices compared with previous months.”

Data from Motilal Oswal showed that Coal India’s average monthly e-auction realisations from higher coal grades has been hovering between Rs 2,505 and Rs 3,044 a tonne during the April-June 2016 period as the coal monolith put 17.66 per cent of the total 26.3 mt under the hammer.

“Higher grade allocation of coal in the auction is likely to increase following the recent changes in the imported coal and pet coke prices as non-power sector will try to purchase more indigenous coal,” said Dhruv Muchhal, an analyst with Motilal Oswal. “There may be an increase in demand of indigenous coal as Coal India has improved its quality of dispatch as well as sending crushed coal. The rise in prices of imported coal will fillip it further,” said Subhasri Chaudhuri, secretary-general of Coal Consumers’ Association of India.

Kannan said: “Chinese demand for thermal coal has been strong in the recent months. China has cut the working days for coal mines, which have restricted supplies by 500 million tonnes and major coal miners like Shenhua have been raising their selling prices in the Chinese market. China's production has dropped nearly 10 per cent year-on-year in the first half of 2016 and, hence, China's January-July total imports have jumped 6.7 per cent year-on-year to 129 mt. Indonesia cut its production by about 50 mt in 2015 and heavy unseasonal rains have caused further supply disruption in the country.”

Rising prices due to supply cuts and expectations in demand pick-up in India and China will keep global coal prices high. Kannan, however, said: “We believe the recent price rise in coal prices of various origins is mainly driven by supply cuts, but we do not see any fundamental changes to the demand scenario.”

)

)