Early-bird results may flatter to deceive

Revenue & net profit growth exceed expectations but analysts say overall picture will be different

Clifford AlvaresSameer Mulgaonkar Mumbai India Inc's early birds - those that have so far announced their results for the quarter ended September 30 - have shown no signs of slowdown but analysts say the optimism could diminish as more companies declare their numbers in the coming weeks.

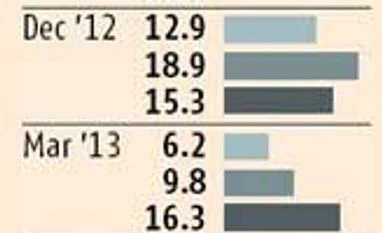

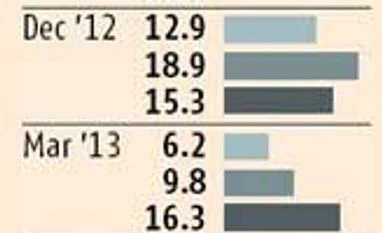

Revenues of the 75 companies that have declared their results so far have shown an annual increase of 17.2 per cent, reversing a declining trend seen in the past three quarters. Net profits have grown 9.11 per cent, a tad lower, as rising input costs are beginning to squeeze bottom lines.

The initial set of numbers have been buoyed by the information technology sector, which has shown tremendous growth, thanks to a 5.4 per cent fall in the rupee's value against the dollar in the second quarter. So far, IT firms' revenues have grown 32.4 per cent and net profits 27.9 per cent. This is the best showing in the past three quarters by IT firms.

Analysts are, however, keeping their fingers crossed. That's because they expect overall profit growth to contract sharply, going ahead.

V Balasubramanian, fund manager (equity), IDBI Mutual Fund, says: "The first of the numbers have been better than expected and, in some cases, the quality of revenue growth has also been good. But I am still expecting the overall results to be very muted." Rising input and interest costs are likely to pull earnings lower, at three-five per cent overall, or even lower, analysts say.

Operating margins in the quarter are already seeing signs of a sharp contraction, coming in at 14.5 per cent, against 15.5 per cent in the preceding quarter. In fact, in the past four quarters, these have been hovering around the 15 per cent mark. Interest costs have increased 10.4 per cent, as the Reserve Bank of India's belt-tightening measures have begun to hit companies.

The sectors where there is stress, according to analysts, are downstream oil & gas companies, cement, public-sector banks, and a few manufacturing companies. The mid- and small-cap space could see more stress ahead on all fronts, including revenue, margin and profit growth.

Rajat Rajgarhia, director (research), Motilal Oswal, says: "This quarter has been a big quarter for IT and export-driven sectors, as currency is driving good part of the earnings. But these numbers don't reflect the true picture. Mid- and small-sized firms will be hit very hard."

Around 40 per cent of the BSE Sensex earnings is from the export-driven sectors, where the currency has had a positive impact and is driving the initial optimism, say analysts.

TCS' net profits surged 34 per cent, as the industry benefitted from a record flow of new contracts.

Larsen & Toubro reported a surprisingly positive revenue growth of 10 per cent year-on-year due to a pick-up in the engineering & construction and heavy engineering segments. PAT growth, too, beat Street expectations, coming in at 12.2 per cent to Rs 978 crore.

Bajaj Auto also reported a strong set of numbers, with its top line growing 4.1 per cent year-on-year to Rs 5,175 cr, while its net profit beat estimates to rise 13 per cent.

)

)