Govt needs to clarify HZL stake sale, say bankers

BS Reporter Mumbai The government proposes to sell its residual stake in Hindustan Zinc Ltd (HZL) to the Vedanta group and raise Rs 14,000 crore, according to the Budget. However, investment bankers say the government needs to clarify how it will sell the stake to Vedanta.

"There is no clarity on these issues. The government will have to clearly say whether it will sell by auction or via the offer-for-sale route," said a banker, who did not wish to be named.

According to investment bankers, many questions need to be answered. For example, will the group get an option to match the best price, if an auction is held for the government's stake sale?

As long as such ambiguities remain, the stake sale to Vedanta is likely to get delayed. This also means Anil Agarwal, the company's chairman, who made a Rs 17,000 crore offer to buy the government's residual stake in both unlisted Balco and Hindustan Zinc by this month-end, will have to wait.

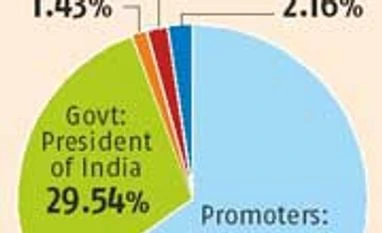

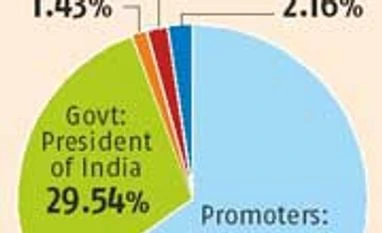

The Centre holds 30 per cent stake in HZL worth Rs 14,577 crore, going by Tuesday's stock price. However, bankers said the stock price was not the right valuation, as the stock is not liquid with only five per cent stake in the market. The valuation will also have to take into account the Rs 7,295 crore cash on the company's balance sheet as on September 2012, they said. Besides, as HZL was set up by an Act of Parliament, the government will have to clarify whether the stake sale needed Parliament approval, bankers added.

In an interview to Business Standard, Agarwal had reiterated his Rs 17,000-crore offer to the government. He said he had no problem even if the government wanted to remain an investor in the company. According to Agarwal, HZL was one of the most profitable companies in the metals sector, after the group managed to turn around the company in record time.

The performance of HZL after Vedanta takeover by Vedanta can be gauged by the fact that the government, which had the option to buy HZL shares at that time at Rs 500 crore, is today getting Rs 14,500 crore.

For the government, it is important to raise funds to meet its disinvestment target set in the Budget. The stake sale of HZL and the offer made by Agarwal will come in handy for the government to meet the target. However, this will largely depend on whether the government sells the shares in a transparent and open system, said bankers.

)

)