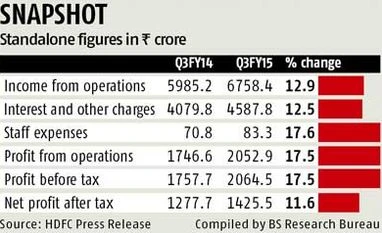

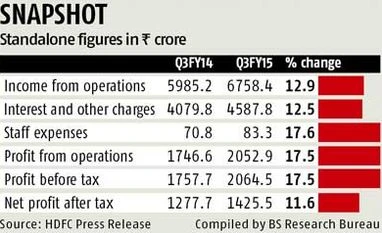

India's top mortgage lender, Housing Development Finance Corporation (HDFC), posted a 12 per cent rise in net profit for the third quarter of FY15 at Rs 1,425 crore on the back of higher loan growth.

As on December 31, 2014, the loan book stood at Rs 2.2 lakh-crore, against Rs 1.9 lakh-crore a year ago, a growth of 14 per cent.

“Between October and December 2014, we sold loans aggregating to Rs 1,234 crore. If you look at the individual loan book, the growth has been faster,” said Keiki Mistry, vice-chairman and chief executive officer.

According to Mistry, the incremental individual loan book has gone up by Rs 22,000 crore in the nine months ended December 31, while the growth for non-individuals has been Rs 4,000 crore.

Profit after tax, excluding the impact of deferred tax liability on the special reserve stood, at Rs 1,513 crore, compared to Rs 1,278 crore in the year-ago quarter, a growth of 18 per cent. In the past, National Housing Bank had directed housing finance companies to provide for deferred tax liability in respect of special reserve.

“Net interest income (NII) before dividend and sale of investments for the quarter stood at Rs 2,068 crore, compared with Rs 1,829 crore in the third quarter of the last financial year. For the nine-month period, NII before dividend and sale of investments stood at Rs 5,835 crore compared to Rs 5,049 crore in the year-ago period with an increase of 16 per cent,” said Mistry.

Net interest margin (NIM) stood at 3.93 per cent in the quarter under review, compared with 3.98 per cent in the year-ago period. “NIM would typically come down by four-five basis points (bps) every year, because we have not raised fresh equity. When we raise capital, NIM will suddenly shoot up,” Mistry added.

According to Mistry, HDFC looks more at spreads than NIMs because NIMs take into account the amount of capital. “Historically, our spreads have been on a fairly narrow band and we expect that to continue. Our spreads in the nine-month period stood at 2.31 per cent,” Mistry noted.

Gross non-performing loans as on December 31, 2014 amounted to Rs 1,517 crore. This is equivalent to 0.69 per cent of the loan portfolio, compared with 0.77 per cent year earlier. The non-performing loans of the individual portfolio stood at 0.53 per cent, while that of the non-individual portfolio stood at 1.03 per cent.

The balance in the provision for contingencies account as on December 31, 2014 stood at Rs 2,001 crore.

Of this, Rs 515 crore was on account of non-performing loans and Rs 1,486 crore was in respect of general provisioning on standard loans and other provisions. HDFC carried an additional provision of Rs 387 crore over the regulatory requirements.

“From a regulatory perspective, we would be required on December 31 to carry a provision of Rs 1,614 crore in the aggregate. Out of that, as much as Rs 1,117 crore is in respect of standard assets. Where there is no default, there is no non-performing loans... But at the same time, because of regulations, whenever we do a loan, we have to get 40 bps of an individual loan and higher percentage of non-individual loans in respect of standard asset provisioning. Against the regulatory requirement of Rs 1,614 crore, we actually carried a provision of as much as Rs 2,001 crore,” said Mistry.

)

)