Hotel Leela: Sale valuations key to debt reduction

Firm will reduce leverage if it can get a premium for the properties

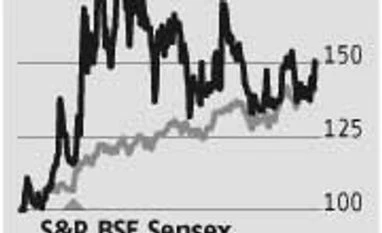

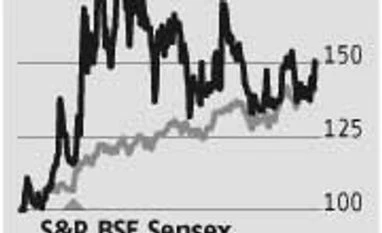

Ram Prasad Sahu Mumbai The Hotel Leela Venture stock was up 6.5 per cent on the firm’s decision to pare down nearly Rs 5,000 crore debt by putting the Chennai and Goa properties for sale. While the Chennai property began operations in 2013 with 326 rooms and was built at a cost of Rs 1,500 crore, Goa is one of its oldest hotels which started operations in 1991 and has 206 rooms. While the former is expected to fetch Rs 5.5 crore per room or Rs 1,800 crore, the latter could get Rs 3.5-4 crore per room or Rs 700-800 crore, bringing in a total of about Rs 2,500 crore for the two properties.

Though the sale will help bring down the debt by half, analysts say more needs be done by way of land bank sale if the company is to return to profits. The company’s interest costs (Rs 501 crore in FY14) could come down to about Rs 275 crore if it manages to cut debt by half. But, given FY14 Ebidta of Rs 195 crore, cut in debt to Rs 1,500 crore and reduction in costs is required. Analysts say the company could get a premium, especially for the Chennai property which is a business destination. The government’s focus on tourism and the increase in foreign tourist could lead to a better business case for the property.

The company’s situation could have been much better had it reduced its debt by Rs 1,000 crore three years ago when debt stood at Rs 4,000 crore. Though the company sold its luxury property at Kovalam, Kerala for Rs 500 crore in 2011 and Chennai IT Park building for Rs 170 crore in 2012, it was not enough. What pegged back the company was the huge capex on the Delhi hotel project which saw debt increase from Rs 2,878 crore in FY10 to Rs 5,125 crore for the six months ended September 2014, thereby impacting its performance.

ALSO READ: Hotel Leela to sell Chennai, Goa hotels to reduce debt

For the nine months ended December 2014, it had revenues of Rs 526 crore and operating profit of about Rs 100 crore. However, an interest burden of Rs 393 crore resulted in a loss of Rs 460 crore. Barring a single quarter, it has been posting losses in each of the last 15 quarters with accumulated losses of about Rs 1,000 crore, of which Rs 875 crore has come in FY13 and FY14.

What has added to its woes is the moderation of growth has coincided with its expansion resulting in jump in assets without proportionate gain in revenues and profits. Given the muted growth of business destinations (78 per cent of its hotels are in business destinations) which saw a fall in occupancy (by 300-500 bps) as well as average room rates (by five-seven per cent) in the last three years, revenue growth has been muted.

)

)