Max India: Demerger gains, budgetary boost priced in

Stock a favourite of most analysts; immediate upside may be limited

Sheetal Agarwal Mumbai Max India stands to gain from the tax incentives provided in the Budget to medical insurance. The deduction limit for health insurance premium under Section 80D has been raised from Rs 15,000 to Rs 25,000 and that for senior citizens from Rs 20,000 to Rs 30,000. While the move will benefit all insurers, Max is the only listed pure-play insurance stock and, hence, will reflect the benefits more accurately.

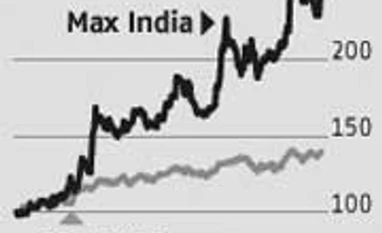

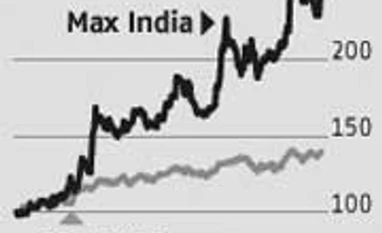

Max’s scrip has surged 150 per cent in the past year, outperforming the benchmark S&P BSE Sensex. Healthy performance of its key businesses - life insurance (Max Life), health insurance (Max Bupa), and Max Healthcare (speciality hospitals) — is one reason for this show.

The firm’s recent plan to de-merge its businesses into separate entities is another. The demerger will result in three separate listed entities – Max Financial Services (existing company which will be renamed and will hold 72.2 per cent stake in Max Life Insurance); Max India (consisting of Max Bupa, Max Healthcare and Antara Senior Living businesses); and Max Ventures and Industries (consisting of the speciality films business).

The Street has cheered Max’s demerger plans as it will allow investors to buy into each business separately. After the demerger, the holding company discount of 10-20 per cent might be wiped out. The firm plans to bring an open offer in its speciality films business, which will increase the promoters’ stake to 75 per cent in the new firm and provide an exit window to investors willing to focus only on the insurance businesses. The demerger is likely to be completed by January 2016.

Analysts expect Max Life to deliver strong return ratios thanks to a robust agency force, banking partner (Axis Bank) and an already well-established traditional (endowment policy) business. Profitability for both Max Bupa and Max Healthcare could improve and provide better earnings visibility, say analysts. Health insurance would need another Rs 200 crore infusion in the next few years, but could benefit from bancassurance tie-ups.

Most analysts are positive on the Max scrip, which appears fairly valued and offers limited upsides. In a February 20 report, Sharekhan analysts advise a ‘hold’ on the stock with a target price of Rs 518. They value the life insurance business at Rs 382 a share for Max, Rs 73 for Healthcare, Rs 28 for Max Bupa, Rs 8 for Specialty and Rs 27 for Treasury. The Bloomberg average price of investors polled since January is around current levels of Rs 471. Investors can, thus, consider the stock on dips.

)

)