India Inc willing to wait for recovery under Modi

CEOs are not happy with scorecard so far but are ready to invest more as they think one year is too short a time to revive the economy

Dev Chatterjee Mumbai A majority of India Inc's leaders are not happy with the Narendra Modi government's performance in its first year in office. But they are willing to give Prime Minister Modi the benefit of doubt, as they feel one year is not enough to revive the economy, shows a poll conducted by Business Standard among 20 chief executives across India.

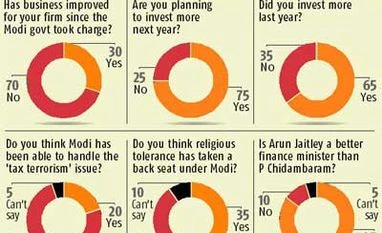

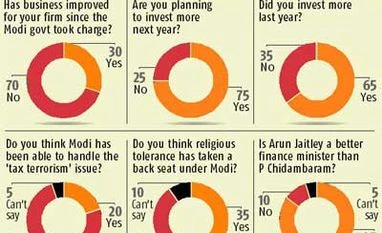

While 70 per cent of the respondents said business conditions had not improved in the first year, in spite of a stable government, 75 per cent said they would invest more next year, given the many pro-reform steps taken by the government.

India Inc compliments Modi for his desire to bring in change and for more decisive leadership than the previous regime. On average, Modi received seven on a scale of 10 (the better the performance the higher the score), but almost all CEOs said there was scope for improvement.

"Modi is 100 per cent on expectations," said Kumar Mangalam Birla, chairman of the Aditya Birla group. "It takes a lot of time for us to turn a company around. And here we are talking about the whole country. It is reasonable to expect the government will take another year before we actually see an impact on the ground," said Birla.

Harsh Goenka, chairman of RPG Enterprises, said Modi deserved a big thumbs-up for changing the mood from gloom to optimism. "The growth momentum is picking up, albeit slowly. The irony is that there was very high expectation, which led to an expectation-delivery mismatch."

A majority of CEOs said they would invest more because business sentiment was expected to pick up from the second half of 2015-16.

Prashant Ruia, promoter of Essar group, said the government was working swiftly and it should not be long before we would start seeing meaningful results on the ground. SKIL Infrastructure Chairman Nikhil Gandhi added the 'Make in India' programme would ensure India became a production hub and new jobs were not lost to China. On his part, Venugopal Dhoot, chairman of Videocon group, wanted India Inc to have a little patience, as the results of initiatives taken by the government would be seen only in the long term.

But it's certainly not roses all the way. A large number of CEOs also wanted Modi to start delivering on his promises, control the Hindu fringe elements within the ruling party, and start streamlining tax laws.

The CEOs reasoned that, apart from finance and transport, the other ministers were still struggling with their priorities. That is why nothing has improved in the infrastructure, power and industrial sectors, a large number of projects remain stalled, the issue of banks' bad loans is still not addressed, and some ministers find themselves in unnecessary controversies like the one over a changed school syllabus.

A lot of the optimism witnessed in May last year has, obviously, taken some hard knocks. CEOs said Modi's promise to streamline retrospective tax laws remained on paper, with notices for minimum alternate tax served on foreign institutional investors damaging investor mood. Around 75 per cent of the surveyed CEOs said the Modi government had failed to address the 'tax terrorism' issue.

The Modi government has removed the controversial MAT on FIIs from April 1 this year, but this has created a sense of uncertainty among foreign investors. MAT on FIIs was imposed by the previous government. Asked whether Arun Jaitley was a better finance minister or P Chidambaram, 85 per cent of the CEOs surveyed chose the former for his willingness to listen to investors' and taxpayers' concerns.

"There is a lot to be done. A lot of work can be done. I am very positive on India's future," said Adi Godrej, chairman of the Godrej group.

(With inputs from Viveat Susan Pinto, Abhineet Kumar, Aneesh Phadnis, Bibhu Ranjan Mishra, B Dasarath Reddy, Arindam Majumder and K Raghavendra Kamath)

)

)