Indian Overseas Bank (IOB) on Thursday reported a net loss for a consecutive quarter reflecting the stress on state-run lenders’ finances due to sustained deterioration in health of assets. Two other lenders — Allahabad Bank and UCO Bank — that announced their third quarter earnings on Thursday also witnessed a year-on-year drop in profit after tax.

Chennai-based IOB said it incurred a net loss of Rs 516 crore in the October-December period as it made more provisions and contained loan disbursements. The public sector bank had also reported a net loss of Rs 245.5 crore in the previous (July-September) quarter.

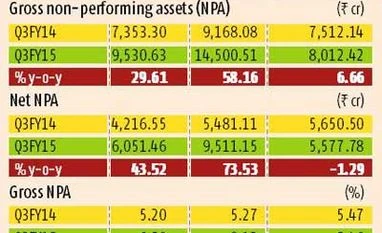

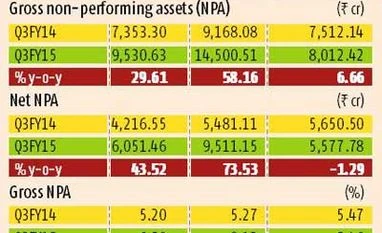

IOB’s gross non-performing assets (NPAs) swelled to Rs 14,501 crore at the end of December from Rs 13,334 crore a quarter ago. Gross NPA ratio deteriorated 77 basis points sequentially to 8.1 per cent. Net NPA ratio was also high at 5.52 per cent compared to 5.17 per cent as on September, 2014. This was despite the bank stepping up its recovery efforts, reducing slippages by almost 50 per cent.

Gross advances, growth was muted at 2.55 per cent, as the bank was cautious in offering fresh loans in the current uncertain economic environment. The bank closed the quarter with Rs 1,78,532 crore of gross advances. IOB's weak earnings performance saw its shares shed close to 10 per cent in Thursday's trade.

Kolkata-based Allahabad Bank and UCO Bank both reported a decline in October-December profit after tax as mounting bad loans and reduced lending opportunities continued to haunt.

Allahabad Bank saw its third quarter net profit plunge by 49.6 per cent from a year earlier to Rs 164 crore as it made higher provisions against standard advances.

While the bank was able to cut its NPA provisions by 37 per cent, its provisions against standard advances surged 235 per cent, on a year-on-year basis, due to loan restructuring.

Total provisions, as a result, were up 33 per cent.

The state-run bank closed the quarter with gross NPAs of Rs 8,012 crore. Gross and net NPA ratios were at 5.46 per cent and 3.89 per cent, respectively. The lender's restructured loan portfolio was at Rs 14,253 crore. Advances were up only 6.8 per cent, on a year-on-year basis, at Rs 1,46,652 crore.

UCO Bank said its October-December net profit fell to Rs 303.6 crore from Rs 314.5 crore a year earlier.

Provisions increased to Rs 907.5 crore from Rs 811.7 crore during this period as asset quality remained weak.

Gross NPA ratio increased by 130 basis points from a year ago to 6.5 per cent, while net bad loan ratio was up 119 basis points at 4.25 per cent.

)

)