M&M pips Bajaj Auto in market cap league tables

M&M's shares went up 16% from its August lows in spite of its Sept quarter sales declining mainly

BS Reporter Mumbai Backed by a significant rise in tractor sales, automobile major Mahindra & Mahindra has pipped two-wheeler maker Bajaj Auto in the market capitalisation league tables at Rs 58,000 crore.

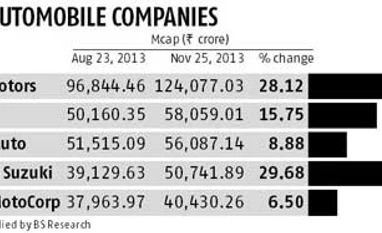

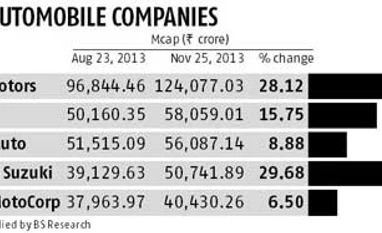

M&M lost its ‘Number 2’ rank to Bajaj Auto in August this year, as investors are betting big on high margin motorcycles. Bajaj Auto’s market capitalisation is now at Rs 56,000 crore (see chart), while Tata Motors continues to remain at the top. M&M lost its position in spite of the company is double the size of Bajaj Auto in terms of revenues. But Bajaj Auto’s margins are at industry’s highest at 22% as compared to Hero Moto Corp’s 10.8% and Mahindra’s 12.8% in the September quarter, making it an investors’ favourite choice.

But M&M’s shares went up 16 per cent from its August lows, in spite of its September quarter sales declining mainly due to a slowdown in its utility vehicles sales. Bajaj Auto shares were up 8.8% in the last three months, as it is fighting a pitched battle with Hero Moto Corp for market share.

Analysts say what has worked in M&M’s favour is the rise in gross margins, which increased 3.47 per cent on a year-on-year basis as mix shifted towards tractors. While M&M’s tractor sales was up 22% since January this year, its auto segment, on the other hand, struggled with falling Ebit (earnings before interest and tax) in the September quarter.

Analysts say in the coming months the competition in the utility vehicle market will continue to remain challenging, and will worsen over the next few quarters as M&M’s share in the segment has declined to below 40% in Q2, down 5.5% on a year-on-year basis.

“M&M is at the wrong end of the product cycle, with multiple launches from competitors over the next few quarters and limited launches from M&M. But its tractor segment will likely see continued growth in the near-term, though at a slower pace than seen recently,” says an analyst.

The going is not very good for Bajaj Auto either. In spite of multiple launches, Bajaj lost market share of 3 per cent in motorcycles during the September quarter.

)

)