M&M to buy 25-30% in Pipavav Defence

Apart from Mahindra, two other corporate majors, including L&T, were in the race to buy stake in Pipavav

Dev Chatterjee Mumbai The Mahindra group is planning to make a big-bang entry into the defence sector, with the acquisition of 25-30 per cent stake in Pipavav Defence, India’s largest private shipyard, based in Gujarat. Banks privy to the deal said the Pipavav Defence board was slated to meet on Friday to approve the transaction.

After a preferential share offer, the Mahindras and Gandhis (current promoters of Pipavav) were likely to hold equal stake and an open offer would be made to the shareholders of Pipavav Defence, said a banker. The Gandhi family owns a 45 per cent stake in the company. “The final contours of the transaction are under discussions between the two, especially the shareholding and the management rights,” the banker added.

On Wednesday, the Pipavav Defence stock closed 16 per cent higher at Rs 64 on the BSE. If the deal is approved, the Mahindras will invest about Rs 1,000 crore in the company, valuing Pipavav Defence at about Rs 4,000 crore.

Apart from Mahindra, two other corporate majors, including Larsen & Toubro, which has a shipyard in Tamil Nadu, were in the race to buy a stake in the shipyard. However, the Mahindra group won the race due to its better offer and a promise to take the company to the next level.

When contacted, a Mahindra spokesperson said the company did not comment on speculation, while a Pipavav Defence spokesperson declined to comment.

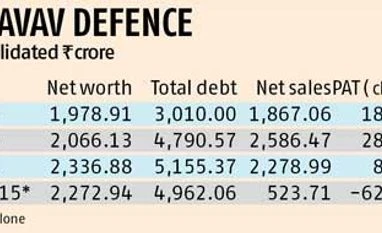

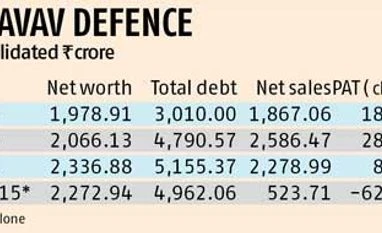

Pipavav is a prized asset due to its well-established infrastructure and a strong order book. Apart from making warships, Pipavav also constructs patrol boats and cargo ships for customers across the world. For 2013-14, the company reported revenue of Rs 2,278 crore and a profit of Rs 8.36 crore.

Analysts said with Pipavav in its bag, Mahindra will get a head start in the defence sector. Currently, Mahindra supplies armoured vehicles to the Indian Army, Air Force, and paramilitary and state police forces. Its vehicles are also exported, through the home and external affairs ministries. The company is the largest private-sector supplier of bullet-proof vehicles in the country. Soon after taking over charge as prime minister last year, Narendra Modi had said India would encourage local companies in sectoral production, adding the country should export defence equipment instead of importing these at a huge cost. Experts say even if the government gives part of its estimated purchase orders worth $247 billion through the next three years to Indian companies, it will change the dynamics of these firms and give a fillip to the domestic economy.

The National Democratic Alliance government’s focus on ‘Make in India’ has created a big opportunity for Indian companies. Also, the government has increased the cap on foreign direct investment in defence to 49 per cent. With the government promising to favour Indian companies in defence orders, there is a rush among Indian entities, including the Tata group, the Mahindra group, Reliance Industries and the Munjals of Hero MotoCorp, to get into the defence sector. Companies such as the Mahindra group, the Tata group and L&T are vying for orders for trucks, jeeps, submarines, frigates, aircraft carriers, offshore patrol vessels, corvettes, missile systems and other military hardware and software. As of now, Russia, France and the US are the biggest suppliers of defence equipment to India.

ALSO READ: Pipavav Defence offers 26% stake sale ALSO READ: Modi booster for Indian defence companies)

)