The hope of an early revival for India’s passenger car industry weakened on Thursday, with Maruti Suzuki, the country’s largest automobile manufacturer, saying its sales in terms of units sold dropped 12.6 per cent in April on an annual basis. This was the company’s biggest sales drop in 11 months.

Taking the 79,119 units sold in the month as an average, the car maker’s sales for full 2014-15 would come to 949,428 units. This would be close to the level previously seen in 2009-10, when the company sold 870,790 units through the entire year. Maruti had sold 1.13 million cars in 2010-11 and 1.01 million in 2011-12.

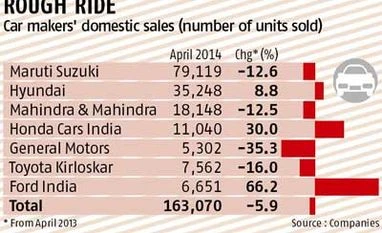

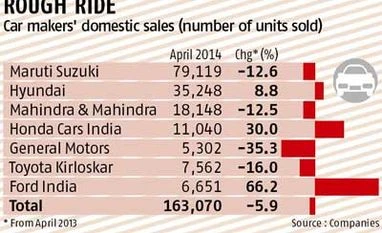

The decline in numbers for the largest car maker in April was reflective of the general trend in the automobile industry. Maruti, along with other top companies — General Motors, Hyundai, Toyota, Mahindra & Mahindra, Honda and Ford — sold a combined 163,070 units in the month, 5.9 per cent fewer than the 173,368 in April 2013. In March, these companies had seen an annual sales decline of 5.2 per cent.

Tata Motors, fourth in the pecking order of car makers, will announce its sales figures on Friday.

The tough time top automobile companies are facing could be gauged from the fact that the overall sales decline for these firms in in April would have been 9.6 per cent if Honda Cars India and Ford India had not posted good numbers, mainly on the back of their bestselling models, the City and the Ecosport, respectively.

The sharp sales drop in the month might make it difficult for the automobile companies to even meet their modest projections for the financial year. Maruti Suzuki Chairman R C Bhargava had earlier said he expected some improvement in the market once a stable government came to power. He said he was looking at sales growth of three to four per cent. The more optimistic analysts pegged growth at six to seven per cent, while PricewaterhouseCoopers said sales growth for the year could be three to five per cent.

Now, after the sharp drop in April, Maruti will have to grow its sales by 5.3 per cent to meet its growth target of four per cent. Bhargava had also pointed out that the cost of running a car had substantially risen due to an increase in petrol prices, adding poor pay increments in the corporate sector might also have forced many to postpone their decisions to buy.

The more worrying news for Maruti Suzuki was that its sales fell across categories. While sales of the Alto and the WagonR declined a whopping 25.4 per cent to 26,043 units, those of the DZire sedan fell 17.7 per cent to 16,008 units. The company’s sales of the SX4 model fell 87.4 per cent. Only the premium hatchback category saw some encouraging traction, growing 9.9 per cent to 23,659 units after introduction of a new model, the Celerio.

It was also clear the excise sops announced for passenger cars in the interim Budget (valid till a new government takes office) had also failed to work for the industry.

Pravin Shah, chief executive (automotive division) at Mahindra & Mahindra, which has seen a substantial drop in sales, said: "It is unfortunate the auto industry has not seen an upturn over the past couple of months, despite a reduction in excise duty. We hope there will be an improvement in sentiment after the general elections."

General Motors India Vice-President P Balendran said: "Customer sentiment continues to remain weak, even with price reduction on account of excise duty cut and other market promotion schemes. Going by the market scenario, we expect the challenging times to continue as the general economic conditions continue to remain depressed."

Even Ford, which had a good run in April, does not expect miracles. Its executive director (marketing, sales and service), Vinay Piparsania, said: "In the run-up to the formation of the next government, we remain cautious and watchful in anticipation of progressive policy interventions to energise the Indian automobile sector."

Toyota, which has also seen a sharp sales decline, of over 16 per cent, blamed it on the union trouble at its Bangalore facility. N Raja, director and senior vice-president (sales & marketing), said: "We resumed normal production on April 22. We were carrying out limited operations until then".

)

)