Monte Carlo shares fall 12% on debut

Shares of the company ended at Rs 566.25 compared to the issue price of Rs 645 per share on NSE

BS Reporter Mumbai Monte Carlo Fashions had a lukewarm market debut, with its shares ending 12 per cent lower compared to the issue price, despite gains in the broader market.

Shares of the company, a maker of woollen clothing, ended at Rs 566 apiece compared to the issue price of Rs 645 apiece on the National Stock Exchange (NSE). The stock moved in a range of Rs 530-632, 7.6 million shares traded.

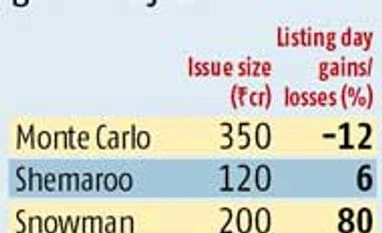

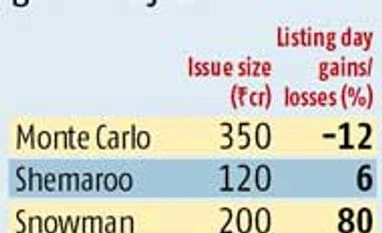

Carlo was year 2014’s first Initial Public Offering (IPO) that ended below its issue price on debut. Excluding small and medium-sized enterprises’ IPOs, five launched issues this year.

Carlo’s shares fared poorly despite a good response to its IPO. The 5.4-million share offering had got 24.9 million bids.

Market players said the shares had ended weak on heavy selling pressure from institutional investors, which had subscribed to the IPO. The portion meant for these was subscribed 14 times during the IPO.

The quota reserved for retail investors — those investing up to Rs 2 lakh — had seen sixfold subscription. High networth (wealthy) individual segment was subscribed less than two times.

Carlo had raised over Rs 100 crore from anchor investors, which included Aditya Birla Private Equity, Tata Mutual Fund and Birla Mutual Fund.

Analysts said a strong balance sheet and an asset-light model were positives but valuations were fairly valued at over 20 times one-year forward earnings estimate.

The company's promoters and private-equity firm Samara Capital had pared their holdings in the company through the IPO to raise Rs 350 crore.

Including Monte Carlo, a total of just Rs 1,200 crore has been raised from the IPO market this year, the lowest figure in more than a decade. Shemaroo Entertainment, Snowman Logistics, Sharda Cropchem and Wonderla Holidays are the other four companies to have come out with IPOs this year.

Investment bankers expect next year to be good for the IPO market. At present, there are about 20 companies that have filed their offer documents with the capital market regulator, Securities and Exchange Board of India. Bankers expect the queue of companies lining up for IPO approvals to get longer.

)

)