Nikesh Arora's exit clouds fresh funding from SoftBank

Experts believe more efforts would be needed in future funding rounds once SoftBank gets someone in Nikesh Arora's place

Karan Choudhury New Delhi It might take a little more convincing by the start-up entities in this country where investments were initiated by Nikesh Arora, ex-president and operations head of SoftBank Group (SBG), to get more funding, say experts.

Analysts have also indicated that investments by the Japanese multinational into Indian companies might slow down for a while.

Start-up bosses such as Snapdeal’s Kunal Bahl and Ola’s Bhavish Aggarwal had said soon after news of Arora’s exit that nothing would change between SoftBank and their companies. However, experts believe more efforts would be needed in future funding rounds once SoftBank gets someone in Arora’s place.

At present, it is believed, there might not be any revisiting of the companies SBG had invested in India. “However, if these companies want to get follow-on investments, it might depend on who is taking the call, as it is possible they might not be that bullish about it,” said Saurabh Srivastava, co-founder, Indian Angel Network and of the IAN Incubator.

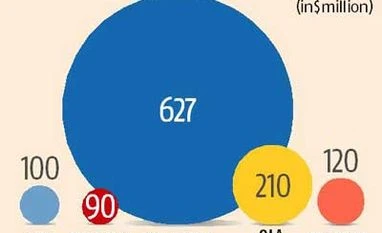

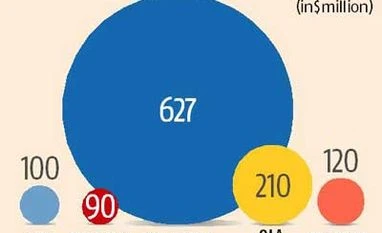

SoftBank has been a key investor, with $210 mn in Ola, along with existing shareholders, $627 mn in Snapdeal, $90 mn in Housing.com and $100 mn in Oyo Rooms. And, $120 mn in Grofers.

Arora, the man behind these big-bang investments, recently faced investor ire for allegedly making a series of questionable transactions and having a poor record on the investments made. There were also allegations of conflict of interest.

While experts laud Arora’s forward attitude towards the investments he made, they believe the going would be tough for some of the investee companies.

“While most investment companies have a four to six-year view of the market, Arora and Masayoshi Son have a 20-year view. Sadly, some of the investments are now becoming a major headache for SBG,” said a senior executive of a major financial firm which also has stake in one the companies SoftBank is invested in.

“Housing.com and Oyo Rooms are still trying to find a firm footing. Our sense is that these would be the two companies that would have to shape up if they want further funding rounds,” another investor said.

However, a source close to Housing.com said SoftBank had full confidence in the company. “They (SBG) are a fantastic investor and stuck through Housing during its worst phase. Now that the company is turning around, I do not think the relationship would change,” he said. Oyo did not respond to a Business Standard query.

)

)