No sign of green shoots as yet

Corporate earnings continue to slide, weighed down by poor demand growth, wage push inflation and rising interest burden

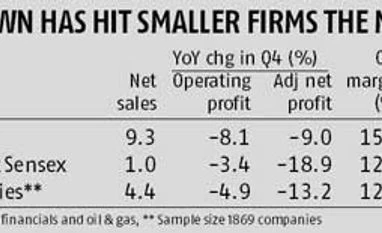

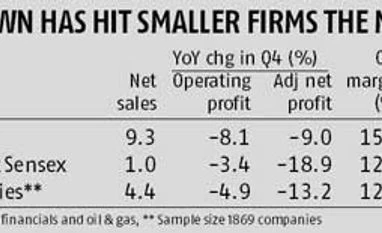

Krishna Kant Mumbai The corporate earnings for the March 2013 quarter is a wake-up call for anybody who expected a quick recovery in India economic growth rate. Revenue growth slumped to three year low and fall in net profit was sharper than the previous quarter. Worse, revenue and profits are still trending down ruling out any uptick in growth in the near term. Nearly 1900 odd non-oil and bank companies in our sample reported 4.4 per cent growth in their net sales down from 5.6 per cent growth in the third quarter and 14.2 per cent in March 2012 quarter. Adjusted for consumer inflation, it hints at fall in volumes and capacity utilisation.

The pain is greatest in basic materials and industrials that includes capital goods, automobiles and consumer durables. Consumer staple companies (Food & FMCG) did relatively better but their topline growth declined and operating margins are under pressure. Construction and infra sector remained under pressure weigh down by fewer orders and rising interest burden. Only stars were top companies in pharma and IT services space that continue to defy economic slowdown.

For bulk of India Inc, demand destruction continues to weigh on profits. The companies in our sample reported 13.2 per cent year-on-year decline in net profits adjusted for other income and exceptional items. The core operating margin remained on a downward trajectory and fell to four year low of 12.4 per cent in Q4, down 130 basis points YoY and 90 basis points on sequential basis. Smaller companies have been hit much harder than Sensex companies. They have taken bigger hit on margins and their balance sheet is more at risk.

(See table) What is surprising is that the hit on margins came despite companies in our sample reporting 0.2 per cent year-on-year decline in their raw material cost. Lower input cost helped companies to lower their raw material intensity by 177 basis points on year-on-year basis and 55 basis points sequentially to 38.1 per cent in Q4. The savings from lower input prices was robbed by rising wages cost (up 17 per cent on y-o-y), interest burden (up 14.6 per cent) and depreciation allowance (up 17 per cent).

This is prompting many analysts to tone down their expectations. "The fourth quarter results were below expectations and it seems that the economic recovery will be delayed by a few quarters but that should not give sleepless nights," says Apurva Shah, head of research at BNP Paribas Asset Management Company.

(Click here for charts) Others however say that the economic slowdown has become structural and it will take years to repair the system. "What we need right now is corporate deleveraging, consolidation and clean-up of the bank balance sheet. This process is only just begun and it will take years for the process to play out fully. We remain bearish and a clear picture will emerge only after the next general election," says Dhananjay Sinha, co-head institutional equity at Emkay Global Financial Services. He says that last time it has taken nearly six years (from 1997 to 2003) for the Indian economy to recover fully from a similar growth crisis. "At best this re-adjustment may be quicker this time but it cannot happen in few quarters either," he adds.

The macro-economic headwinds is clearly visible in the industrial and commodity space. As shown in the chart below, the sector has been one the worst affected by the economic slowdown with stagnant revenues and 20 per cent decline in net profits. Numbers would look worse if we exclude handful of outliers such as M&M, Maruti, Havells and Tata Motors. The only silverlining is that the most leading companies remain healthy. Basic material makers including metals, cement and chemicals are in a similar situation but their problems have been compounded by an over leveraged balance sheets. Cement makers are better placed in this regard.

The sector most at risk is however construction and infrastructure. It grew on the back of a credit boom and but with actual revenue falling short of projections and working capital cycle getting longer, many companies find themselves in a debt spiral. On average, industry operating profit in FY13 covered only 30 months of their interest obligations against 67 months in FY09. With former growing slower than latter, the coverage ratio is likely to fall further. Given that the sector account for bulk of bank credit, bankers would be worried.

The slowdown is however also bringing out the best in India Inc and this is clearly visible in the pharma and the IT sector. The top companies here are using the slowdown to race ahead of the competition. This augurs well for India growth story given our competitive advantage in the two sectors.

)

)