Indian sees 21% jump in smartphone shipment: IDC

In the third quarter, the 4G enabled devices have witnessed almost a three-fold increase in unit shipments over the previous quarter in 2015

BS Reporter Pune One out of every three smartphones shipped to India in third quarter of 2015 are 4G enabled, said report by International Data Corporation’s (IDC). According to IDC’s Quarterly Mobile Phone Tracker, 28.3 million smartphones were shipped to India in the third quarter of 2015 – up 21.4 per cent from 23.3 million units for the same period last year.

In the third quarter, the 4G enabled devices have witnessed almost a threefold increase in unit shipments over the previous quarter in 2015. Samsung emerged as the biggest 4G player in India with its popular sub $150 LTE models such as Galaxy Grand Prime and Galaxy J2.

“4G enabled devices are expected to be at the forefront, with the entire ecosystem preparing for this shift in the near future,” said Kiran Kumar, research manager, IDC.

IDC expects the share of smartphones to outstrip the share of feature phones market in CY 2016 for India. Low prices and better value would continue to drive migration in the coming years. Also smartphones will continue to maintain a healthy double-digit growth over the next few years.

"e-tailers such as Flipkart, Snapdeal and Amazon continue to drive shipments of the Chinese vendors, who have been aggressively trying to capture the 4G smartphone market in India,” adds Karthik J, senior market analyst, Client devices. The closing weeks of the quarter witnessed an increase in supplies as many vendors were preparing their channels in lieu of the festive season and online mega sale programs.

Growth was also driven by phones with larger screens at low cost. “Almost one out of every two smartphones sold, had 5” plus displays,” says Jaipal Singh, market analyst, Client Devices. Most of the popular models in the market today support 4G coupled with a large screen and attractively priced at less than $200.

“This highlights the shift in consumer preference from a device mostly used for voice calling to an advanced multimedia experience.” Singh added.

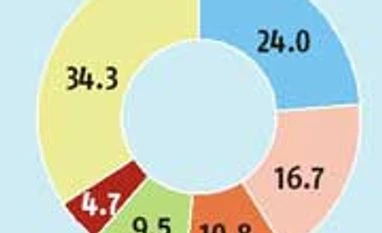

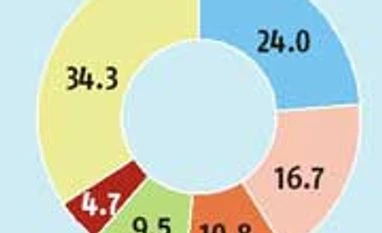

Samsung continues to lead the Indian smartphone market with 13.1 per cent sequential growth (quarter-on-quarter) in Q3 2015 over Q2 2015, and also overtook Lenovo as the top 4G vendor.

The volume growth was primarily contributed by the LTE based smartphones such as Galaxy Grand Prime 4G, Galaxy J and Galaxy A series which mostly moved through the retail channels. Samsung also had some e-tailer focused phones such as Galaxy J5 and Galaxy J7.

Micromax retained the second position in Q3 2015 with a 6.4 per cent sequential growth (quarter-on-quarter). YU Phones have been performing well and are leading contributors to Micromax’s 4G portfolio. However, YU faces strong competition from Chinese players in the online segment, said IDC.

Intex secured the third position in Q3 2015 with 9.4 per cent growth. The vendor witnessed a sharp rise in shipments in sub $50 segment and also entry-level 3G enabled devices.

)

)